Energy in the United States made some significant achievements in 2011 that may be a turning point for future in-roads, particularly relating to oil and natural gas production. Oil production in 2011 was at its highest level in 8 years, thanks to state and private lands where the bulk of production is occurring. Natural gas production exceeded all past production highs. Oil and natural gas imports were at a 12 and 13 year low, respectively. What is making these achievements possible is technology (hydraulic fracturing and horizontal drilling) that has made shale oil and shale natural gas drilling and production economic.

Coal production in 2011 was at a three year high and coal exports were at a level not seen in a decade. While the United States government is doing all it can to reduce U.S. consumption of coal in electric generation through environmental regulations, other countries are using coal to energize their economies and are turning to the United States for its vast coal resources, the largest in the world.

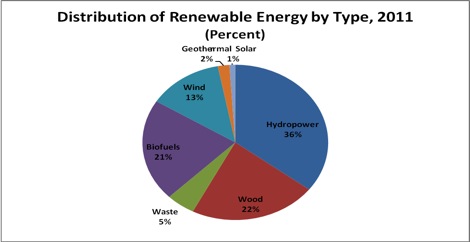

Renewable production in 2011 was at its highest level ever, led by hydroelectric production that increased 25 percent from 2010 levels and was at its highest level since 1999 as a result of precipitation and run-off in the Western United States. In the electric generation sector, hydroelectric production was followed by biomass generation and wind generation, respectively, as the second and third largest renewable forms of electric generation. However, biofuels production (ethanol, biodiesel) exceeded that of wind energy in the production pecking order. Mandates and financial incentives have helped to increase biofuels and wind energy production. However, some of these financial incentives expired at the end of 2011 including the subsidy on ethanol and the 1603 program that provided 30 percent of the investment cost in qualified renewable energy technologies as rebates to developers.

Source: Energy Information Administration, Monthly Energy Review, March 2012, http://www.eia.gov/totalenergy/data/monthly/pdf/sec1_7.pdf

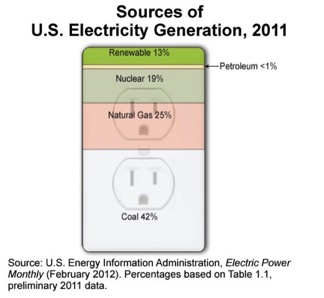

While prices for oil and gasoline are creeping up and nearing their all time peak, natural gas prices have dived due to the glut of natural gas in this country. Natural gas wellhead prices averaged $3.95 per thousand cubic feet in 2011, 12 percent below their 2010 average, helping natural gas increase its footing in the electric generation market with a 25 percent share in 2011, its largest ever. The glut of natural gas was the result of a mild winter and production boom that has pushed down its futures price to around $2 per thousand cubic feet after peaking at $4.85 last summer.[i]

Specifically,

- Oil production reached 2.07 billion barrels in 2011, 3.6 percent higher than in 2010. Oil demand totaled 6.87 billion barrels, 1.8 percent less than in 2010 due to higher oil prices resulting in less driving and to higher average automobile efficiency. Net imports represented a 45 percent share of oil consumption and were 10.6 percent lower than 2010 levels due to higher domestic production of oil, natural gas liquids and biofuels; lower demand; and higher exports of petroleum products.[ii]

- Oil production on federal and Indian lands declined in fiscal year 2011 by 13 percent, led by a decline of 17 percent in offshore oil production, while oil production on private and state lands increased by 11 percent. [iii] The decline in offshore oil production was largely due to the moratorium on offshore drilling that the Obama Administration imposed in May 2010 after the oil spill accident in the Gulf of Mexico.

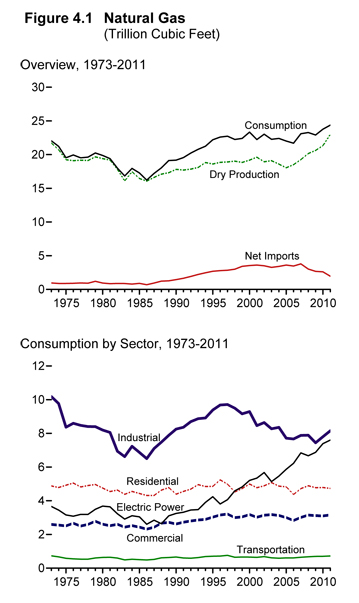

- Dry gas production was at an all time high of 23 trillion cubic feet in 2011, 7.8 percent higher than in 2010. Natural gas demand totaled 24.4 trillion cubic feet, 2.5 percent higher than in 2010. The increases were primarily in the industrial sector, increasing by 4.5 percent over 2010 levels and reaching its highest industrial consumption level since 2004, and the electric generation sector, increasing 2.9 percent over 2010 levels and its highest electric generation level in history. Net natural gas imports were 25 percent lower than in 2010 and at their lowest level since 1992 due to higher domestic production, higher exports, and lower gross imports.[iv]

- Natural gas production on federal and Indian lands declined 10 percent in fiscal year 2011 from the prior fiscal year level and declined 31 percent from fiscal year 2003 levels. Clearly, the oil and gas industry prefers drilling and producing oil and natural gas on private and state lands to the bureaucratic requirements of obtaining leases and permits from the federal government.

Source: Energy Information Administration, Monthly Energy Review, March 2012, http://www.eia.gov/totalenergy/data/monthly/pdf/sec4_2.pdf

- Coal production reached 1.089 billion short tons in 2011, its highest level since 2008. Coal demand, however, was only 1.003 billion short tons, 4.6 percent less than in 2010. Coal consumption for electric generation, its primary usage, was down 4.8 percent from 2010 levels and at its lowest level since 1997 as low cost natural gas and steeper environmental regulations pushed coal further out of the electricity market. Coal exports were at their highest level since 1991, reaching over 107 million short tons.[v]

- Nuclear energy provided 19 percent of our electricity in 2011, a slightly lower share than in 2010, but still achieving capacity factors of around 90 percent. [vi]

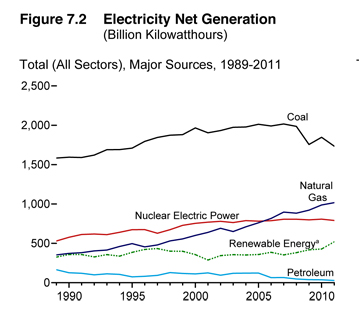

- Electricity generation was down by 0.5 percent in 2011 from 2010 levels. Generation from coal, petroleum, and nuclear energy were each lower than in 2010. Electricity generation from natural gas, hydroelectric power, geothermal, wind, and solar were higher than in 2010. Generation from natural gas increased by almost 3 percent and represented a 25 percent share of total generation. Renewable generation increased 22 percent from 2010 levels led by a 25 percent increase in hydroelectric power. Together renewables represented 12.7 percent of total generation, with hydroelectric power generating 7.9 percent of total generation. Coal’s share of generation fell from 45 percent in 2010 to 42 percent in 2011. Wind generation increased its share to 2.9 percent from 2.3 percent in 2010.[vii]

Source: Energy Information Administration, Monthly Energy Review, March 2011, http://www.eia.gov/totalenergy/data/monthly/pdf/sec7_4.pdf

Conclusion

Despite massive subsidies and government-guaranteed markets for wind, solar, ethanol, and other politically-favored energy sources, oil, coal, and natural gas production all increased in the United States in 2011. Not only that, but oil, coal, and natural gas provided the lion’s share of the energy we consumed. Hopefully, governments will stop trying to pick winners and losers in the energy market and let American choose their energy source for themselves.

[i] Associated Press, Natural gas prices dip below $2, April 11, 2012, http://www.google.com/hostednews/ap/article/ALeqM5h4zsZre3_A1HQmg02JDKmh4evpwQ?docId=bbf6cf5c6289401fac492446cd5792ab

[ii] Energy Information Administration, Monthly Energy Review, http://www.eia.gov/totalenergy/data/monthly/pdf/sec3_3.pdf

[iii] Energy Information Administration, Sales of Fossil Fuels Produced from Federal and Indian Lands, FY 2003 through FY 2011, March 14, 2012, http://www.eia.gov/analysis/requests/federallands/pdf/eia-federallandsales.pdf and Congressional Research Service, U.S. Crude Oil Production in Federal and Non-Federal Areas, March 20, 2012, http://freebeacon.com/wp-content/uploads/2012/03/R42432.pdf

[iv] Energy Information Administration, Monthly Energy Review, http://www.eia.gov/totalenergy/data/monthly/pdf/sec4_3.pdf and http://www.eia.gov/totalenergy/data/monthly/pdf/sec4_5.pdf

[v] Energy Information Administration, Monthly Energy Review, http://www.eia.gov/totalenergy/data/monthly/pdf/sec6_3.pdf and http://www.eia.gov/totalenergy/data/monthly/pdf/sec6_4.pdf

[vi] Energy Information Administration, Monthly Energy Review, http://www.eia.gov/totalenergy/data/monthly/pdf/sec8_3.pdf

[vii] Energy Information Administration, Monthly Energy Review, http://www.eia.gov/totalenergy/data/monthly/pdf/sec7_5.pdf