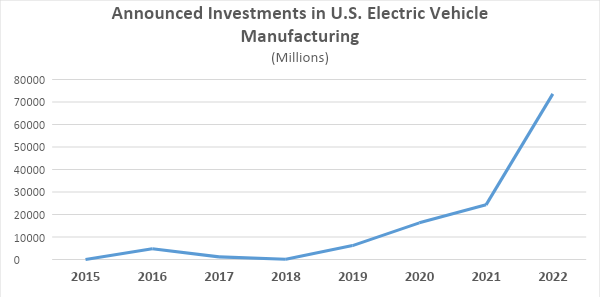

Government subsidies get people to buy products that would otherwise fail in free and open markets. A perfect example is electric vehicles and their component parts. President Biden’s spending package in the Inflation Reduction Act included tax credits to encourage companies to manufacture EV batteries in the United States. Axios reports that these credits reduce production costs of batteries by a third, offering battery manufacturers a tax credit of $35 per kilowatt-hour for each U.S.-made cell, but that the lost revenue from those tax credits may be four times higher than Congress’ budget experts anticipated. The Congressional Budget Office projected the tax revenues lost to these tax credits at $30.6 billion over 10 years. Others put the figure at $136 billion over the same period and probably more as it does not include Tesla’s recently announced multi-billion dollar investment. New battery investments in 2022 totaled more than $73 billion, more than three times the previous record set in 2021.

The Inflation Reduction Act (IRA) resets and modernizes EV tax credits, adds credits for used cars for the first time, and incentivizes the production of both cars and batteries in the United States as manufacturers that produce abroad do not qualify for the credits. A goal of the IRA is to build a homegrown battery and EV manufacturing infrastructure so that industry is not entirely dependent on China, who holds as much as 90 percent of global production of some key components for batteries. Both car companies and battery manufacturers building facilities in the United States can take advantage of the tax credits. For instance:

- Tesla expects to earn $1 billion in battery tax credits in 2023. Its Nevada plant will soon be able to produce 100 gigawatt-hours of battery cells, and that could grow to 500 gigawatt-hours in the future. At an annual production rate of 500 gigawatt-hours, the credits would be worth $17.5 billion per year.

- Ford expects more than $7 billion in tax breaks from 2023 to 2026, and a “large step-up in annual credits” starting in 2027.

- GM expects to earn about $300 million this year, with the credits eventually being worth $3,500 to $5,500 per vehicle.

The IRA has infuriated our foreign allies, such as the European Union, Japan and South Korea, because of the law’s requirement that vehicles be manufactured in the United States to qualify for a $7,500 consumer tax credit and at least 40 percent of the minerals required be sourced domestically or from an ally with a free trade agreement. Foreign automakers like Japan’s Honda and South Korea’s Hyundai announced plans for multibillion dollar electric vehicle manufacturing plants in the United States in 2022.

Electric vehicle sales increased here and aboard in 2022, while new car sales overall fell around 1 percent globally to 80.6 million vehicles, with nearly 4 percent growth in China offsetting a decline of 8 percent in the United States and 7 percent in Europe. The market share of electric vehicle sales in the United States increased from 3.2 percent in 2021 to 5.8 percent in 2022, as manufacturers took aggressive steps to promote their electrified products in the United States. Despite this increase, the United States lagged behind China and Europe, where roughly 19 percent and 11 percent of new vehicle sales were fully electric, pushing the global market share to 10 percent. Global sales of fully electric vehicles totaled around 7.8 million units, an increase of as much as 68 percent from the previous year.

This momentum in EV sales, however, may be short-lived as subsidies for electric vehicles are being rolled back in Europe and the price of electricity continues to increase here and abroad. If an economic downturn should hit in 2023, demand for new cars is likely to decline, potentially forcing car companies to cut prices and sacrifice profits to entice customers to purchase new vehicles. Tesla and Ford have already cut prices of some of their electric vehicle models.

Conclusion

President Biden has a goal to get 50 percent of all new vehicles sold in the United States to be electric by 2030. To reach that goal, the administration wants to invest in EV infrastructure and does not mind making taxpayers, who are already suffering from high inflation, fund lucrative tax credits. Some are now estimating the tax credits will cost over four times as much as predicted when the bill was passed. But, through these subsidies the government is picking winners and losers, and history has shown that the government usually fails when it interferes with the market.