Source: Energy Information Administration, Financial Reporting System

The increasing global demand for crude oil has led to record-high prices and enabled major oil companies to post record earnings in recent years. Some lawmakers have decried the profits as excessive, calling for the enactment of a “windfall profits tax” and other fees and taxes to penalize the oil companies.

Total Earnings, Profit Margins, and Tax Rates: Is a windfall profits tax necessary?

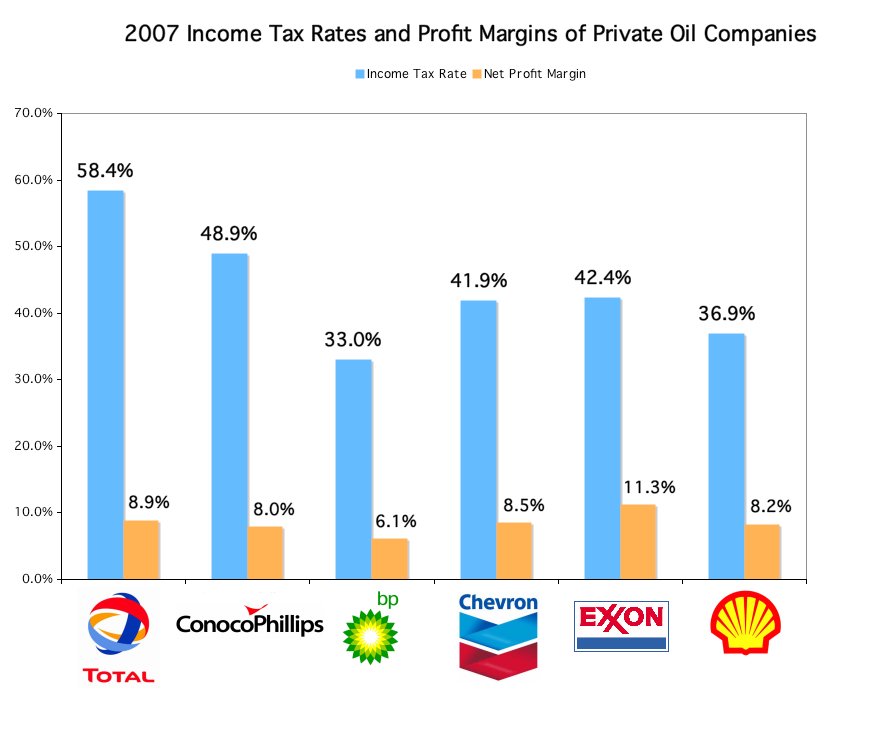

According to the Energy Information Administration’s Financial Reporting Survey (FRS), the major energy corporations earned $64.7 billion from U.S. production activities in 2006 (the most recent and compete data available) and paid $23.5 billion in federal, state and local income taxes. That’s an effective tax rate of 36.3 percent.

On their foreign oil and gas production, FRS companies made $98.3 billion on their foreign oil and gas production in 2006 and paid $49.2 billion in income taxes, for about a 50 percent rate. Thus, globally, according to the EIA, FRS companies paid income taxes at an effective 44.6 percent rate in 2006, up from a 41.1 percent rate in 2005, about double the income tax rate for manufacturing companies.

Total taxes paid to the U.S. Treasury (taxpayers) for 2007 and 2008 are expected to break all records.

Windfall Revenues for the Federal Government (Taxpayers)

In addition to massive income tax bills, energy companies are required to pay “royalties” and “bonus bids” for the right to explore for and produce oil and gas on federal lands. The taxpayer’s total return from royalty payments was $4.95 billion in fiscal year 2000, $10.7 billion in fiscal year 2006, and is projected to exceed $20 billion for fiscal year 2008.

In point of fact, rising oil and gas revenues have provided a “windfall” of new revenue for the federal government. Those seeking to increase taxes on energy producers should recall the lessons of the past. When President Carter signed a windfall profits tax on the oil companies, its proponents estimated that it would yield an additional $393 billion in gross revenue for the federal government. Yet when President Reagan ended the tax, it had raised less than $80 billion in gross revenue and had resulted in a dramatic decline in domestic energy production and greater dependence on foreign sources of energy.

See also: A breakdown of energy subsidies by source.