On May 7, Interior Secretary Sally Jewell testified before the Senate Appropriations Committee on the President’s 2014 Budget Request. In an otherwise unremarkable and perfunctory presentation, Jewell’s testimony provides further insight into the Obama administration’s hostilities to low-cost, reliable energy production on federal lands. Predictably, Jewell blithely referenced the President’s so-called “all-the-above energy strategy,” yet she failed mention that oil and natural gas production is down on public lands, even as oil and natural gas production are dramatically rising on private and state lands. Given Jewell’s testimony, it appears that she will continue the anti-affordable energy agenda of her predecessor Ken Salazar. The Institute for Energy Research combed through Jewell’s testimony to fact-check her words against the administration’s record:

Jewell Statement: The Department’s oil and gas development activities accounted for nearly $9.7 billion of the receipts generated by Interior’s activities in 2012. For the past several years, Interior has targeted investments in America’s energy future, particularly to encourage the development of renewable energy on the Nation’s public lands and offshore areas where it makes sense. In 2009, there were no commercial solar energy projects on or under development on the public lands. From 2009 through March 2013, Interior authorized 37 renewable energy projects on or through the public lands which, if constructed, will have the potential to produce enough electricity to power more than 3.8 million homes.

IER’s Comment: The Department of Interior has been hostile to oil, natural gas, and coal development while strongly promoting renewable development on federal lands. While Jewell points out that “oil and gas development activities accounted for nearly $9.7 billion of the receipts generated by Interior’s activities in 2012” she fails to mention that this is a far cry from the $24 billion in total reported revenues for 2008 when the Bush administration finally got serious and leased land for energy production.[i]

Jewell tries to justify the emphasis on renewable energy by claiming that these projects “have the potential” [emphasis added] to power 3.8 million homes. The key here is the word potential. The only time these projects will actually provide enough electricity to power 3.8 million homes is on the very rare occasions that the wind is blowing hard enough and the sun is at its peak.

This is because the renewable projects that the Secretary of the Interior is referring to are primarily wind and solar projects that need to be backed up by fossil fuel technologies when the wind does not blow or the sun does not shine. Therefore, it is a misleading to translate their proposed capacity into generation levels and compare that generation to the number of homes that the electricity could supply.

For example, early in the summer of 2006 as well as on later occasions, California faced record heat conditions that strained its ability to meet a peak demand of 50,000 megawatts. The resources at that time included 2,323 megawatts of wind capacity. However, wind’s average on-peak contribution over the month of June was only 256 megawatts or barely 10 percent of the nominal amount.[ii] This example shows that data on installed wind capacity is of little or no value in predicting the actual power the system can get from it at peak times.

Another example occurred in August, 2012, when the California Independent System Operator (ISO) issued a “flex alert” that called for a reduction in use of lights, air conditioning, and appliances, i.e. the CA ISO called for electrical conservation in order to avoid black-outs. At that time, California had 4,297 megawatts of installed wind capacity, but less than 100 megawatts were operating at 11 am on August 9, 2012, or just 0.02 percent of electricity demand. While solar was contributing more at 11 am than wind, by 5 pm when demand was at its highest, solar’s electrical generation output waned and wind’s output was increasing but not enough to meet demand. Wind’s more sizable generation levels do not occur until the late night or very early morning hours when they are least needed. The California Independent System Operator has on many occasions expressed concerns about its ability to maintain reliability in the face of a 33 percent renewable portfolio standard for 2020 that will require a tripling of wind and solar power production.[iii]

Similarly, the Electricity Reliability Council of Texas (ERCOT) is responsible for dispatching the state’s generation, administering its energy markets, and monitoring the adequacy of resources to meet growing demand. For planning purposes, ERCOT treats a megawatt of wind capacity as equivalent to only 8.7 percent of a megawatt of dispatchable fossil fuel capacity.[iv] In other words, ERCOT counts only 8.7 percent of wind’s nameplate capacity as dependable capacity at peak periods of electricity demand.

Jewell’s Statement: A stronger America depends on a growing economy that creates jobs. No area holds more promise than investments in American energy, with the potential to provide clean, low cost, reliable, and secure energy supplies. Success depends on the Country’s ability to pursue an all-of-the-above energy strategy. Interior’s energy resource programs are at the forefront of this objective.

IER’s Statement: There is no evidence that the administration is pursuing an all-of-the-above energy strategy, unless the term all-of-the-above does not include oil, coal, and natural gas—the source of 80 percent of our energy consumption. As we discuss below, oil and natural gas production is falling on federal lands, the number of permits issued has fallen, and the numbers of acres leased has fallen. It appears that the term “all-of-the-above” means something different to the Department of Interior.

Furthermore, while we agree 100 percent that a stronger American depends on a growing economy that creates jobs, there is no reason to believe that economic success is apparently dependent on subsidized wind and solar development as Jewell’s testimony implies. There is an energy revolution that has occurred over the past few years, but as the Associated Press recently explained, it is “not the one we expected.” The AP continues:

By now, cars were supposed to be running on fuel made from plant waste or algae — or powered by hydrogen or cheap batteries that burned nothing at all. Electricity would be generated with solar panels and wind turbines. When the sun didn’t shine or the wind didn’t blow, power would flow out of batteries the size of tractor-trailers.

Fossil fuels? They were going to be expensive and scarce, relics of an earlier, dirtier age.

But in the race to conquer energy technology, Old Energy is winning.

Oil companies big and small have used technology to find a bounty of oil and natural gas so large that worries about running out have melted away. New imaging technologies let drillers find oil and gas trapped miles underground and undersea. Oil rigs “walk” from one drill site to the next. And engineers in Houston use remote-controlled equipment to drill for gas in Pennsylvania.

The result is an abundance that has put the United States on track to become the world’s largest producer of oil and gas in a few years. As domestic production has soared, oil imports have fallen to a 17-year low, the U.S. government reported Thursday.

The Department of Interior is stuck in the past, promoting and subsidizing the sources of energy such as wind and solar which some people thought would work, instead of allowing the American people to figure out what is the most cost-effective and affordable. The administration’s strategy of subsidizing unaffordable, unreliable sources of energy has proven to be incredibly ineffective and inefficient. According to data from the Department of Energy, the DOE has spent $26 billion since 2009 on loan guarantees for “advanced energy” projects, but only created about 2,300 permanent jobs. That works out to over $11 million per job created.

Jewell’s Statement: Significant progress has been made to advance offshore wind energy. In 2012, BOEM issued the second non-competitive commercial wind lease off the coast of Delaware, and moved forward with first-ever competitive lease sales for wind energy areas off Virginia and Rhode Island/Massachusetts. These sales involve nearly 278,000 acres proposed for development of wind generation to produce electricity to power as many as 1.4 million homes. The 2014 budget includes $34.4 million in BOEM for offshore Renewable Energy development.

IER Comment: Instead of allowing access to affordable energy resources on taxpayer-owned lands, the Department of Interior has devoted substantial resources to pursuing some of the most expense sources of energy available, such as offshore wind.

According to the Energy Information Administration, a new offshore wind farm is more than double the cost of a new onshore wind farm and more than triple the cost of a natural gas combined cycle plant. Per kilowatt hour, offshore wind is expected to cost 22.15 cents, while onshore wind is expected to cost 8.66 cents and natural gas combined cycle is expected to cost 6.56 cents.[v] At 22.15 cents per kilowatt hour, offshore wind is more than twice the average cost of electricity in the United States. So, why taxpayers’ money is being used to support such a program is bewildering.

Let’s look at the specific case of Cape Wind off Cape Cod, Massachusetts. Cape Wind was originally proposed in 2001 as a 468-megawatt wind farm consisting of 130 turbines, each with a maximum capacity of 3.6 megawatts, standing 440 feet tall in the Nantucket Sound, off Cape Cod, Massachusetts, covering 25 square miles.[vi] Because the turbines are to be located more than 3 miles offshore, it is under federal jurisdiction as well as state jurisdiction.[vii] The project is estimated to cost $2.5 billion, or over $5,300 per kilowatt. The project has one primary buyer, National Grid, the state of Massachusetts’ largest electric utility, who is slated to purchase half of the output from the project, at a cost of 18.7 cents per kilowatt hour and then increase annually by 3.5 percent in a 15-year deal. Note that it would exceed EIA’s levelized cost number by about 50 percent at the end of the 15 years. That initial cost, 18.7 cents per kilowatt hour, is twice what the utility pays for power from fossil fuels and almost twice the average cost of electricity in the United States. It would add 1.7 percent to the electricity bill of residential customers.[viii

Jewell’s Statement: In calendar year 2012, the Bureau of Land Management held 31 onshore oil and gas sales. Although we planned to conduct 33 sales in 2013, the sequester is anticipated to result in fewer and smaller lease sales. The BLM sales resulted in 1,707 parcels of land receiving bids in 2012, 30 percent more than in 2009.

IER Comment: According to the Bureau of Land Management (BLM) website, the BLM held 27 oil and gas lease sales in calendar year 2012, with 1,635 parcels receiving bids, 22 percent more than in 2009. But comparing 2012 data to 2009 data, both Obama Administration years, is similar to comparing bad apples to rotten apples, there is simply no difference. While the statistics Sally Jewell used in her testimony are not available for prior administrations, other statistics reveal the underperformance of the BLM in regard to lease sales as compared to prior administrations. For instance, during the Obama Administration, BLM issued 52 percent fewer new leases than under the Clinton Administration, when 3,764 new leases were issued on average and 37 percent fewer leases than under the Bush Administration, when 2,879 leases were issued on average. (The Obama Administration issued 1,824 new leases on average in the 4 years he has been in office.)

Further, the Obama Administration leased fewer acres compared to the prior 2 administrations–about 50 percent less. The average new acres leased under the Obama administration was 1,758,875 compared to 3,432,719 under President Bush and 3,412,108 under President Clinton. Further, the BLM has upped the average time it takes to process a permit to drill from 154 days in 2005 to 228 days in 2012,[ix] which compares very unfavorably to state data where it takes 27 days in Colorado,[x] 14 days in Ohio,[xi] and 10 days in North Dakota to process a permit to drill.

Jewell’s Statement: Interior has been similarly active in supporting offshore production of oil and gas, while continuing to stress management and oversight reforms identified as a result of the Deepwater Horizon incident. At the end of 2012, more rigs were operating in the Gulf than in the previous two and a half years, equaling the number of rigs in the Gulf before the Deepwater Horizon oil spill. In 2012 alone, BSEE approved 112 new deepwater well permits, higher than in either of the two years preceding the Deepwater Horizon oil spill.

IER Comment: Again Sally Jewell chooses to compare 2012 data to prior year data during the Obama Administration rather than comparing it to data from prior administrations. According to the Energy Information Administration, in 2012, 48 rigs were operating offshore, compared to 31 in 2010 and 32 in 2011. But, the average number of rigs operating offshore during the Bush presidency was 99, twice the 2012 number under the Obama presidency, and the average number of rigs operating offshore during the Clinton presidency was even higher at 116 (data from 1995 to 2000).

Jewell’s Statement: Interior released a new five-year program for offshore leasing last year, making areas containing an estimated 75 percent of the technically recoverable offshore oil and gas resources available for exploration and development. In March 2013, BOEM held the second Gulf of Mexico sale under the new OCS Plan, drawing 407 bids on 320 tracts covering more than 1.7 million acres offshore Alabama, Louisiana, and Mississippi, with high bids totaling $1.2 billion.

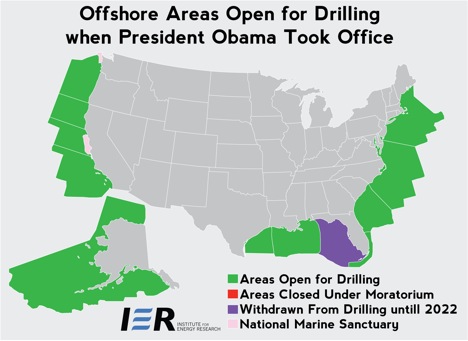

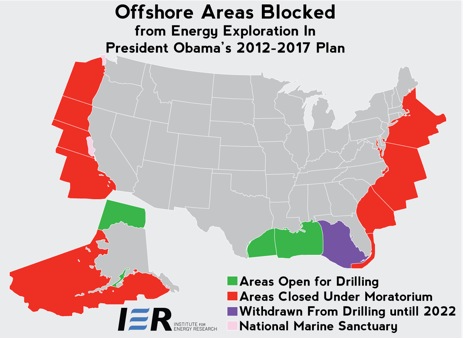

IER’s Comment: The current five-year program dramatically restricts the acreage available for lease. After oil prices reached new highs in 2008, the Bush administration and Congress moved to open almost all of the outer continental shelf to oil and gas exploration and development. The Obama Administration held off leasing these areas and in November 2011, released an offshore drilling plan that closes much of the offshore United States to oil and gas drilling that had been opened by President Bush and Congress. Because the lease plan goes through 2017, those offshore areas will be closed to energy exploration and production through at least 2017. The plan allows lease sales to mainly occur in the portions of the Gulf of Mexico and Alaska that were already open to leasing, leaving the entire Atlantic and Pacific coasts off-limits.[xii]

It is also deceiving to claim, as Jewell’s testimony does, that “an estimated 75 percent of the technically recoverable offshore oil and gas resources are available for exploration and development.” This is deceptive because when people are able to explore more and more oil and gas resources are found and become “technically recoverable.” For example, in the Williston Basin, the USGS just released a new analysis which found that the Williston basin contains and estimated 7.4 billion barrels of undiscovered technically recoverable oil, double the USGS’s 2008 assessment. The 7.4 billion barrels is also an almost 50-fold increase in the recoverable oil estimated by the U.S.G.S. to be in the Williston basin since 1995. Some resource analysts have estimated the recoverable oil there to be over 20 billion barrels.

Not only are more resources found onshore when people are able to explore, but offshore as well. During the past fifteen years, the mean estimate of barrels of oil in the Gulf roughly quintupled and the mean estimate of natural gas in the Gulf nearly trebled. However, estimates in the state of Alaska have remained static because there is little or no new data from exploration.

These data show the value of allowing access to explore, but the Department’s latest 5-Year plan does the opposite and even decreases the number of offshore lease sales. In the past, lease plans for outer continental shelf development averaged five lease sales a year. The 2012 to 2017 plan cuts those lease sale offerings in half.[xiii] And, it contains higher minimum bids and shorter lease periods. Bonus bids are likely to go up by a factor of two for some deepwater tracts and lease terms are reduced to 5 or 7 years. Because developing offshore leases takes a long time, additional costs can make marginal properties sub economic.[xiv] This is not the policy Interior would pursue if it were serious about increasing oil and natural gas production on federal lands. In fact, it is exactly opposite the plan that Interior would pursue if it wanted to increase production.

Opening areas that are off-limits either statutorily or due to administration policy would provide additional revenue for the government, provide for increased economic growth, and increase jobs. The Congressional Budget Office (CBO) estimated last August that under current policies, oil and gas revenues will generate almost $150 billion over the next 10 year period from royalties, rents, and bonuses. They further estimated that if those resources currently off limits were immediately opened to oil and gas leasing, another $7 billion would be realized in that term.[xv] The CBO study estimates are considered to be conservative when compared to historical data and estimates by other analysts and do not consider the earnings from taxes paid by these industries or their employees.

In partial response, but also for public education, the Institute for Energy Research (IER) commissioned a report that provides the larger economic effects, including economic growth, wages, jobs, and federal and state and local tax revenues, of opening Federal lands and waters to oil and gas leasing. The IER paper relies on the CBO natural resource and oil and gas price estimates to maintain direct comparability with the CBO analysis while recognizing that those figures have historically been proven to vastly underestimate resources and revenues. The government’s resource information is poor in large part due to the lack of exploration resulting from practices limiting access to federal lands such as the moratoria.

The study finds that if the federal government opened up federal lands and waters to exploration and production, the increase to GDP to be $127 billion annually for the next seven years, and $450 billion annually in the long run. Most impressively, the opening of federal lands could have a cumulative increase in economic activity of up to $14.4 trillion over a period of 30 years. And the ripple effect of that boom would be 552,000 in job gains annually over the next 7 years with annual wage increases of up to $32 billion over that time period and an increase of 1.9 million jobs annually in the long run with annual wage increases of $115 billion. Federal and state and local tax revenues would also increase to the tune of $2.7 trillion in federal revenues and $1.1 trillion in state and local revenues over 30 years.[xvi]

Even historically, government revenues received during the Obama years were less than government revenues received in fiscal year 2008. Revenues in fiscal 2008 were more than double those received in fiscal years 2011 and 2012, and 2.5 times those received in fiscal years 2009 and 2010. The main reason for the drop in revenues is that fewer federal lands and waters were being offered than in fiscal year 2008 and those that were offered were less attractive than the fiscal 2008 offerings.

Further, while President Obama claims responsibility for the increased domestic oil and gas production, oil and gas production on federal lands is declining because of actions by the Obama Administration, namely the moratorium after the Deepwater Horizon accident and the government delays and cancellations in providing leases. Crude oil production on federal lands is 4 percent lower in fiscal year 2012 than in fiscal year 2011, (a smaller percentage than its reduction in fiscal year 2011 compared to fiscal year 2010 levels), with the total percentage reduction over the 2 years at 15 percent. Offshore oil production in federal waters was 8 percent lower in fiscal year 2012 compared to fiscal year 2011 with the total percentage reduction over the past 2 years at 23 percent.

Natural gas production on federal lands is the lowest in the 11 years that data is available and is 7 percent lower in fiscal year 2012 than in fiscal year 2011 with a total percentage reduction over the past 2 years of 15 percent. Offshore natural gas production in federal waters is 20 percent lower in fiscal year 2012 compared to fiscal year 2011 with a total percentage reduction over the past 2 years of 32 percent. The falling production on federal lands is in stark contrast to the dramatically increasing production on private and state lands where oil production increased by 35 percent and natural gas production increased by 40 percent between 2007 and 2012.

Jewell’s Statement: In 2012, Interior also oversaw the first new exploratory activity in the Alaskan arctic in a decade, with Shell Oil Company beginning limited preparatory drilling activities in the Chukchi and Beaufort Seas under strict safety and environmental oversight.

IER Comment: While Shell did explore in the Alaskan arctic in 2012, Shell has been forced to spend $4.5 billion over five years on planning and development costs and other expenses dealing with repeated permitting delays by the Department of Interior to drill in the Beaufort and Chukchi Seas off Alaska. The increased costs were due to challenges and legal actions by environmental groups to invalidate the proposed permits that the Obama Administration did little to oppose.

Shell spent $2.1 billion for its tracts in the Chukchi Sea in a 2008 lease sale, and was prepared to start drilling during the summer of 2010.[xvii] But the oil spill accident in the Gulf of Mexico that April resulted in a moratorium on all offshore drilling, in both shallow and deep waters, by the Obama Administration. Then, Shell lost the entire 2011 drilling season because the EPA’s Appeals Board overruled the EPA on an air permit it had approved for sources of emissions from ships 70 miles from human habitation, even though ships have never been considered stationary sources of emissions for purposes of securing a permit.[xviii] This was after a study demonstrated that energy development in the Arctic would generate almost $200 billion in government revenue over 50 years, while creating almost 55,000 jobs nationwide over those same 50 years.[xix]

Shell has had to secure around 35 permits each year from various agencies in order to proceed to drill. The company has routinely exceeded many of the requirements of the government in order to ensure safe operation. For example, Shell has taken a number of precautions to prevent a blowout: it has outfitted the blowout preventer on the Kulluk, a 266-foot ship with a hull reinforced for ice, with a second set of shear rams that could shut down the well in case the first set fails; it has engineered a backup cap-and-containment system similar to the one that stopped the BP blowout; and it ensured that it had oil-spill response vessels and other equipment in the Arctic that could support a cleanup in the unlikely event that one would be needed.

In late August 2012, Shell finally received permission to begin work on a well in the Chukchi Sea, about 90 miles off the Alaskan North Slope. The Obama administration gave Shell permission to start “certain limited preparatory activities,” including work related to the installation of a blowout preventer, on August 30. [xx] But, no access to subsurface areas which might contain hydrocarbons was permitted.

Shell’s original plan was to drill 5 wells during the summer of 2012—2 in the Beaufort Sea off the northern Alaska coastline and 3 in the Chukchi Sea off the northwest coast between Alaska and Russia.[xxi] Their drilling plans were diminished due to weather and sea ice, regulatory hurdles, and law suits from environmental organizations to the point where Shell was not able to drill for an oil well last summer, but could only drill for the top portion of wells, “top holes”.[xxii] The company was saddled with a damaged containment dome, which could not be fixed in time to drill before the government-ordered shortened season stopped them from completing a well. Over the years, Shell has had to deal with over 50 law suits from environmental organizations.

Due to uncertainty of the rules and regulations that it must undertake, Shell with not drill in the Alaskan Arctic in 2013. Because of Shell’s problems with U.S. regulatory agencies, other companies with Arctic leases are holding off their drilling plans. Statoil, a Norwegian oil company, spent $23 million to acquire exploratory rights in 66 tracts of the Chukchi Sea in a 2008 lease sale. It had originally planned to begin exploratory drilling 120 miles off Alaska’s northwest coast on its Amundsen Prospect, but is delaying its plans until after 2015 due to the regulatory challenges that have confronted Shell. Conoco Philips acquired 98 leases in the 2008 sales, paying the government $506 million. The company planned to begin exploratory drilling on the Devil’s Paw prospect in the Chukchi Sea in 2014 and submitted an oil spill response plan in February 2012 and an exploration plan in March 2012 to federal regulators. Neither plan has been approved as of yet.

Conclusion

Sadly, it appears that Sally Jewell is following Ken Salazar’s lead of denying Americans access to affordable and reliable sources of energy, such as oil, coal, and natural gas from taxpayer-owned lands. Her testimony shows that the administration is far more concerned about providing subsidies and special treatment for wind and solar rather than merely allowing access to people to explore for energy. Oil and natural gas production is up on private and state lands, but it is falling on federal lands. Federal lands contain vast energy resources, but the federal government has been working diligently to keep the vast majority of these resources off limits. Jewell’s testimony is one more piece of evidence that the administration is not serious about increasing affordable and reliable oil and natural gas production on federal lands.

[i] It should be noted that according to the Office of Natural Resources Revenue, the total reported revenue for FY 2012 was $12 billion. http://statistics.onrr.gov/ReportTool.aspx

[ii] Robert J. Michaels, “Run of the Mill, or Maybe Not,” New Power Executive, July 28, 2006, 2. The calculation used unpublished operating data from the California Independent System Operator

[iii] California Independent System Operator, Reliable Power for a Renewable Future, 2012-2016 Strategic Plan. http://www.caiso.com/Documents/2012-2016StrategicPlan.pdf

[iv] Lawrence Risman and Joan Ward, “Winds of Change Freshen Resource Adequacy,” Public Utilities Fortnightly, May 2007, 14 -18, 18; ERCOT, Transmission Issues Associated with Renewable Energy in Texas, Informal White Paper for the Texas Legislature, Mar. 28, 2005, http://www.ercot.com/news/presentations/2006/RenewablesTransmissi.pdf

[vi] http://www.boemre.gov/offshore/AlternativeEnergy/PDFs/FEIS/Section2.0DescriptionofProposedAction.pdf

[vii] Wikipedia, Cape Wind, http://en.wikipedia.org/wiki/Cape_Wind

[viii] Institute for Energy Research, https://www.instituteforenergyresearch.org/2010/12/29/expensive-offshore-wind-in-need-of-customers/

[ix] Bureau of Land Management, Average Application for Permit to Drill (APD) Approval Timeframes: FY2005–FY2012, http://www.blm.gov/wo/st/en/prog/energy/oil_and_gas/statistics/apd_chart.html

[x] Dave Neslin to Colorado Oil and Gas Conservation Commission, Apr. 25, 2011, http://cogcc.state.co.us/announcements/CommissionLtr4_25_11.pdf

[xi] Ohio Division of Oil and Gas Resources Management, 2011 Ohio Oil and Gas Summary, http://ohiodnr.com/portals/11/publications/pdf/oilgas11.pdf

[xii] U.S. House of Representatives, Obama Administration Imposes Five-Year Drilling Plan on Majority of Offshore Areas,http://naturalresources.house.gov/News/DocumentSingle.aspx?DocumentID=267985

[xiii] The Hayride, Interior Department’s 5-Year OCS Plan Is A Step Backward, November 11, 2011,http://thehayride.com/2011/11/interior-department%E2%80%99s-5-year-ocs-plan-is-a-step-backward/

[xiv] Oil and Gas Journal, Latest proposed 5-year plan falls short, API official says, November 21, 2011,http://www.ogj.com/articles/print/volume-109/issue-47/general-interest/latest-proposed-5-year-ocs-plan.html

[xv] Congressional Budget Office, Potential Budgetary Effects of Immediately Opening Most Federal Lands to Oil and Gas leasing, August 2012, http://cbo.gov/sites/default/files/cbofiles/attachments/08-09-12_Oil-and-Gas_Leasing.pdf and Institute for Energy Research, https://www.instituteforenergyresearch.org/2012/05/08/obamas-offshore-plan-one-giant-leap-backwards/

[xvi] Institute for Energy Research, Beyond the Congressional Budget Office: The Additional Economic Effects of Immediately Opening Federal Lands to Oil and Gas Leasing, Joseph R. Mason, February 2013, https://www.instituteforenergyresearch.org/wp-content/uploads/2013/02/IER_Mason_Report_NoEMB.pdf

[xvii] Anchorage Daily News, Oil company delays exploration in Arctic waters off Alaska, September 6, 2012,http://www.adn.com/2012/09/06/2614308/oil-company-delays-arctic-exploration.html#storylink=cpy

[xviii] Fox News, EPA Rules Force Shell to Abandon Oil Drilling Plans, April 25, 2011,http://www.foxnews.com/us/2011/04/25/energy-america-oil-drilling-denial/

[xix] Northern Economics, Potential National-level Benefits of Alaska OCS Development, February 2011,http://www.northerneconomics.com/pdfs/ShellOCS/National%20Effects%20Report%20FINAL.pdf

[xx] CNN, Shell starts preparatory drilling for offshore oil well in Alaska, September 10, 2012,http://www.cnn.com/2012/09/09/us/arctic-oil/index.html

[xxi] Reuters, Time ticking on Shell’s offshore Arctic drilling, July 25, 2012, http://www.reuters.com/article/2012/07/26/shell-alaska-idUSL4E8IP7YZ20120726

[xxii] Business Week, Shell Suffers Alaska Oil Drilling Setback after Dome Damage, September 17, 2012,http://www.businessweek.com/news/2012-09-17/shell-suffers-alaska-oil-drilling-setback-after-dome-damage