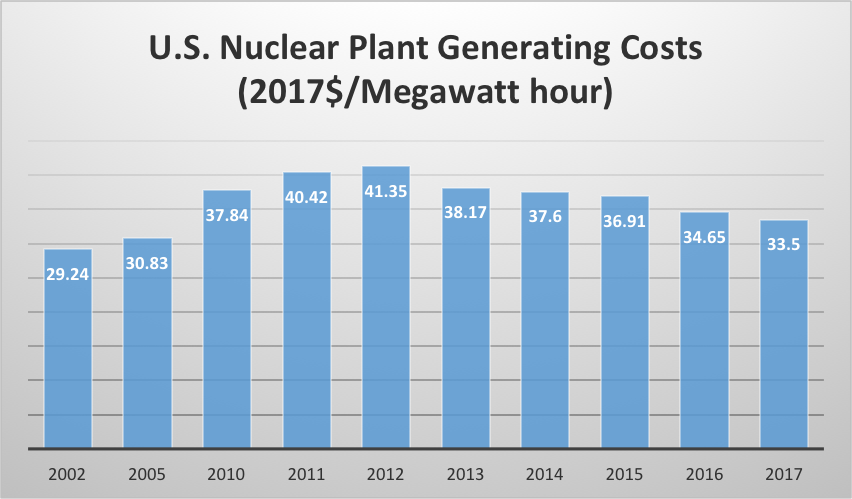

Despite an unfavorable regulatory climate, the U.S. nuclear power industry reduced total generating costs at existing plants in 2017 to a ten-year low. The average total generating costs, including capital, fuel, and operating costs, was $33.50 per megawatt-hour in 2017—3.3 percent lower than in 2016 and more than 19 percent lower than the 2012 peak. Since 2012, the industry has reduced capital expenditures by 40.8 percent, fuel costs by 17.2 percent and operating costs by 8.7 percent.

In 2012, nuclear operators were preparing their plants for 20-year license extensions by replacing vessel heads and steam generators and making other upgrades including uprates to increase output from existing plants. As a result, 86 of the 99 operating reactors in 2017 received 20-year license renewals and 92 of the operating reactors have been approved for uprates that added over 7,900 megawatts of electric capacity.

However, since 2013, seven U.S. nuclear reactors were permanently closed and another 12 have announced their future shutdown due to lower economics from competing plants, some of which are heavily subsidized, and by policy. For instance, plants in competitive markets have retired because of a combination of the following:

- Low natural gas prices that are suppressing prices in wholesale power markets

- Low growth or no growth in electricity demand in some markets due to greater efficiency and/or low economic growth

- Federal subsidies and state mandates for renewable generation that suppresses prices, particularly during off-peak hours. For example, the Federal production tax credit allows wind to bid negative prices. In Illinois, some nuclear plants are confronted with negative prices as much as 10 to 11 percent of off-peak hours and 5 to 6 percent of all hours.

- Transmission constraints, which require a power plant to pay a congestion charge or penalty to move power onto the grid. Some nuclear plants at congested points on the grid have paid a penalty of $6 to $9 a megawatt hour to move their power

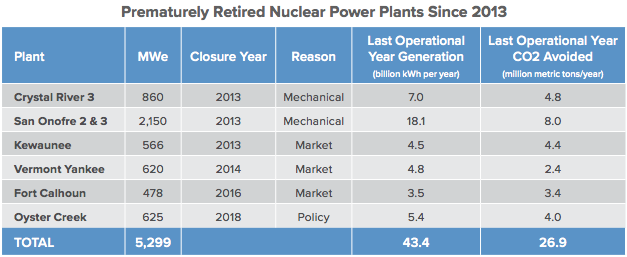

Prematurely Retiring Nuclear Plants

Since 2013, seven nuclear reactors have permanently retired, as noted in the table below.

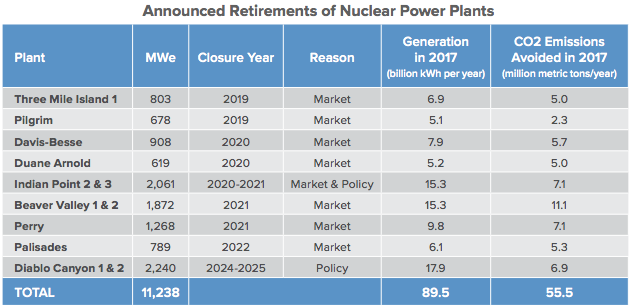

Some states (New York, Illinois, New Jersey, and Connecticut) have enacted policies that will compensate nuclear plants for their environmental attributes, keeping 12 reactors in these states operating. Nevertheless, twelve additional reactors are scheduled for permanent closure as noted in the table below; many with high capacity factors and low generating costs:

Other Countries Are Keeping or Are Building Nuclear Plants

A sample of nuclear power around the globe includes:

- Last month, Taiwanese voters rejected the government’s phase-out of nuclear power by a vote of 59 percent to 41 percent. Taiwan generated 8 percent of its electricity from nuclear power in 2017.

- China has 44 nuclear reactors in operation as of September 2018 with a capacity of 40.6 gigawatts and 13 new reactors are under construction with a capacity of 14 gigawatts. An additional 36 gigawatts are in the planning stages. On December 13, China announced the first commercial operation of a new generation of nuclear plants using European Pressurized Reactors (EPR).

- India has 22 nuclear reactors in operation in seven nuclear power plants as of March 2018, with a total installed capacity of 6,780 megawatts. Nuclear power supplied 3.22 percent of Indian electricity in 2017. Another six reactors are under construction with a combined generation capacity of 4,300 megawatts.

- South Korea has 23 nuclear reactors with a total installed capacity of 20.5 gigawatts. They represent 22 percent of South Korea’s total electrical generation capacity and 29 percent of total electrical consumption.

- Russia’s installed nuclear capacity totals 31,315 megawatts as of December 2018. Russia plans to increase the number of reactors in operation from 31 to 59. Old reactors will be maintained and upgraded.

- France has 58 nuclear reactors with a total capacity of 63.1 gigawatts and they generate the majority (72 percent) of France’s electricity. France is the world’s largest net exporter of electricity due to the low cost of its generation, and gains over €3 billion per year from these exports.

Conclusion

The nuclear power industry lowered its costs and it is trying to compete in markets with natural gas generation and subsidized renewable power. However, it is finding that difficult and reactors are retiring despite their ability to produce electricity at relatively low costs and high capacity factors. Eliminating the Federal subsidies on renewable energy would help the industry to compete in these markets. Other countries are enjoying and even constructing additional nuclear reactors to supply reliable baseload power to their countries.