A recent article published by Vox leads readers to believe that subsidies for oil, coal and natural gas outweigh those for renewable energy.[i] The article is based on a study from Oil Change International, titled “Dirty Energy Dominance: Dependent on Denial: How the U.S. Fossil Fuel Industry Depends on Subsidies and Climate Denial.”[ii]

The Oil Change International study quotes fossil fuel production subsidies (an average of 2015 and 2016) of $20.5 billion, of which $14.87 billion are for federal subsidies and the remainder ($5.8 billion) are for state-level incentives. The Energy Information Administration (EIA) and the Congressional Research Service (CRS) find federal fossil fuel subsidies to be much lower. EIA finds federal fossil fuel subsidies for fiscal year 2013 to be $3.33 billion (in 2013 dollars) and the CRS calculates federal fossil fuel tax provisions, a subsidy component, in 2016 at $5.2 billion. Neither organization provides an estimate of state-level subsidies.

As shown below, the Oil Change International numbers are inflated by claiming items such as lost royalties for onshore/offshore oil drilling and low-cost leasing of coal in the Powder River Basin as subsidies when they are not.

Comparison of Fossil Fuel Subsidies and Renewable Subsidies

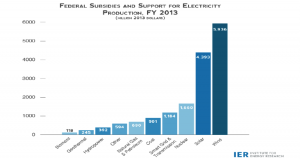

The Oil Change International study fails to provide an estimate of subsidies for other fuels such as wind and solar energy. However, the studies by EIA and CRS provide federal subsidies for those energy sources and find them to be much larger than federal fossil fuel subsidies. EIA finds federal renewable energy subsidies to be $15.053 billion—almost 5 times the federal fossil fuel subsidy level in 2013.[iii] EIA’s subsidy value includes direct expenditures, tax expenditures, research and development, the Department of Energy’s loan guarantee program and federal and RUS electricity. EIA also breaks down its subsidies by fuel type. The following graph compares EIA’s federal subsidies and financial incentives for electricity production by fuel type.

Source: EIA, https://www.eia.gov/analysis/requests/subsidy/pdf/subsidy.pdf

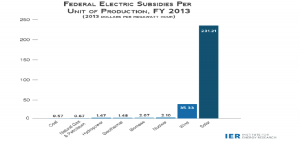

On a unit of production basis and when adjusting for the federal subsidies and interventions for electricity output, the disparity in federal support becomes even greater because wind and solar contributed only a small share of the total market. At $231 per megawatt hour, the federal support for solar in 2013 is about 400 times the federal support for coal.

Source: IER calculations based on data from EIA (2015). “Direct Federal Financial Interventions and Subsidies in Energy in Fiscal Year 2013.”

The CRS calculated 2016 tax provisions for renewable energy at $11.1 billion—over twice the fossil fuel value. By far the largest subsidies in the CRS analysis were the production tax credit for wind at $3.4 billion and the investment tax credit for solar at $2.6 billion. Their expected 2016 to 2020 value is $25.7 billion for the production tax credit and $13.6 billion for the investment tax credit. The largest fossil fuel tax provision, according to CRS, in 2016 was the expensing of intangible drilling costs at $1.8 billion. These costs are expected to reach $8 billion over the 2016 to 2020 period, far below the production tax credit for wind and the investment tax credit for solar. [iv]

The Oil Change International vs. CRS Tax Provisions for Fossil Fuels

The CRS provided actual tax provisions for fossil fuels for 2016 totaling $5.2 billion. The Oil Change International study provided estimates of tax provisions for 2015 and 2016 and an average of the two years. The table below compares the tax provisions of the Oil Change International study using its 2016 estimate to the CRS actual values for 2016. The Oil Change International tax provisions are 30 percent higher than those in the CRS study.

| Comparison of Tax Provisions for Fossil Fuels—Oil Change International and CRS | 2016 Estimate

(Billion $) VOX |

2016 Estimate

(Billion $) CRS |

| Expensing of intangible drilling costs | 2.267 | 1.8 |

| Expensing of percentage over cost depletion | 1.301 | 0.9 |

| Amortization of G&G expenditures for oil & gas exploration | 0.070 | 0.1 |

| Credits for investing in clean coal facilities | 0.160 | 0.2 |

| Amortization of air and pollution control facilities | 0.500 | 0.5 |

| Exceptions for energy related publicly traded partnerships | 2.473 | 0.9 |

| Credits for alternative fuels and alternative fuels mixtures | 0 | 0.8 |

| Total | 6.771 | 5.2 |

Subsidies in the Oil Change International Study

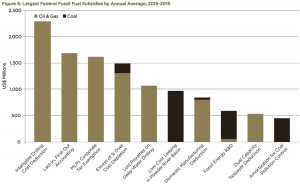

The Oil Change International study lists dozens of subsidies; the largest that they note are listed in the graph below. Note that last-in, first-out accounting, the domestic manufacturing credit and the dual capacity taxpayer deduction are allowed for all U.S. industries. Also note that the characterization of lost royalties on deep water drilling and low-cost leasing in the Powder River Basin as subsidies relies on a subjective valuing of federal resources.

Source: https://www.vox.com/energy-and-environment/2017/10/6/16428458/us-energy-subsidies

Intangible Drilling Cost Deduction

Independent oil producers are allowed to count certain costs associated with the drilling and development of their wells as business expenses. The law allows small independent producers (fewer than 20 employees) to expense the full value of these costs to encourage them to produce oil from marginal wells that are old or small and do not produce much individually. According to the Independent Petroleum Association of America, independent producers drill 95 percent of the oil and natural gas wells in the United States. They develop 54 percent of the onshore oil and they hold 81 percent of the producing leases in the offshore Gulf of Mexico, accounting for 30 percent of the oil production there.[v] The major oil companies get a portion of this deduction—they can expense a third of intangible drilling costs, but they must spread the deductions across a five-year period. This tax treatment is similar to that of other businesses for such investments as research and development.

The Oil Change International estimate for expensing of intangible drilling costs in 2016 is about 25 percent higher than the CRS actual value. (See table above.)

Last-In, First-Out Accounting

All U.S. taxpayers may use the Last-In-First-Out (LIFO) method of accounting that allows companies to assume for accounting purposes the cost of the inventory most recently acquired to estimate taxable income.

Master Limited Partnerships Tax Exemption

The Master Limited Partnership Tax Exemption allows a tax exemption for energy-related publicly traded partnerships. The Oil Change International estimate for this tax deduction in 2016 is almost 3 times higher than in the CRS study for 2016.

Expensing of a Percentage Over Cost Depletion

As the oil and gas in a well is depleted, independent producers are allowed a percentage depletion allowance to be deducted from their taxes. The percentage depletion allowance is similar to the treatment given other businesses for depreciation of an asset. The tax code essentially treats the value of a well as it does the value of a newly constructed factory, allowing a percentage of the value to be depreciated each year. This allowance was first instituted in 1926 to compensate for the decreasing value of the resource, and was eliminated for major oil companies in 1975. This allowance applies only to the first 1,000 barrels of production during the period, so it is of little significance to large independent producers.

The Oil Change International estimate for this tax deduction is almost 50 percent higher than the CRS value.

Lost Royalties on Deep Water Drilling

The deep water royalty relief program originally provided royalty relief for operators to develop fields in water depths greater than 200 meters (656 feet). The suspension of federal royalty payments for new leases was limited to a certain level of production based on water depth. The original terms and conditions expired in November 2000, and since that time, a revised plan was adopted that is no longer based on volumes determined by water-depth intervals. Instead, the Department of Interior assigns a lease-specific volume of royalty suspension based on how the determined suspension amount may affect the economics of various development scenarios with the most economically risky projects receiving the most relief, while others may receive no relief. For example, a deep-water field might not receive any relief if it is adjacent to an existing gathering system. On the other hand, a similar field may receive a great deal of relief if it is located far beyond the current pipeline infrastructure. If the royalty relief program did not exist, the technology would not have been developed to produce oil and natural gas in the deep water Gulf of Mexico.[vi]

During the Clinton era, the Honorable Hazel O’Leary, Secretary of Energy defended the program. In a letter on page H11872 of the Congressional Record in support of the legislation, the Secretary said, “Comparing this loss (foregone royalties) with the gain from the bonus bids on a net present value basis, the federal government would be ahead by $200 million. It is important to note that affected OCS projects would still pay a substantial upfront bonus and then be required to pay a royalty when and if production exceeds their royalty-free period. A royalty-free period … would help enable marginally viable OCS projects to be developed, thus providing additional energy, jobs and other important benefits to the nation.”[vii]

The authors of the Oil Change International study assessed an additional $1.2 billion as lost royalties from deep water oil and gas production despite the current treatment described above.

Low Cost Leasing in the Powder River Basin

A royalty rate of 12.5 percent is obtained for coal mined by surface mining methods and 8 percent for coal mined by underground mining methods. Coal mined in the Powder River Basin is surface mined and pays the 12.5 percent fee—the same royalty fee that the oil and gas industry pays.[viii] The authors of the Oil Change International Study assessed a higher amount of $963 million as an additional subsidy despite the current law. President Trump’s Department of Interior is reevaluating royalty rates for all energy industries, including renewable energy, to see if Americans are getting a fair return for our natural resources.[ix]

Domestic Manufacturing Deduction

The purpose of the domestic manufacturing tax deduction is to incentivize companies to continue to do business in America. The United States now has the highest tax rate in the world among developed countries, and due to these high tax rates, companies have been making investments overseas. The domestic manufacturing tax deduction allows all industries and businesses (not just fossil fuel companies) to deduct a certain percentage of their profits. For fossil fuels industries, the tax deduction is 6 percent; for all other industries (software developers, video game developers, the motion picture industry, among others), it is a 9-percent deduction.

Dual Capacity Tax Payer Deduction

All U.S. taxpayers may use the dual capacity tax payer deduction if it is applicable. The United States taxes its citizens, residents and corporations on their worldwide incomes. Because the countries in which income is earned also may also tax the same income, foreign source income earned by U.S. persons may be subject to double taxation. To mitigate this possibility, the United States provides a credit against U.S. tax liability for foreign income taxes paid or accrued.[x]

Conclusion

There are numerous supposed fossil fuel subsidies in the appendix of the Oil Change International report that many analysts would not consider subsidies. A few of those are mentioned above. The Oil Change International report did not compare its fossil fuel subsidies to those for renewable energy. But, as can be seen from the EIA and CRS analyses, subsidies and tax provisions for renewable energy are far greater than for fossil fuels.

IER supports broad-based tax reform that would eliminate targeted tax credits and deductions for all firms, but in the meantime, the tax code should treat coal, oil and natural gas producers the same as it treats the rest of U.S. businesses or manufacturers for performing comparable activities. Ultimately, government policies should not distort energy markets, and the tax code should not favor or disenfranchise particular sources for political ends.

[i] VOX, Friendly policies keep US oil and coal afloat far more than we thought, October 7, 2017, https://www.vox.com/energy-and-environment/2017/10/6/16428458/us-energy-subsidies

[ii] Oil Change International, Dirty Energy Dominance: Dependent on Denial, October 2017, http://priceofoil.org/content/uploads/2017/10/OCI_US-Fossil-Fuel-Subs-2015-16_Final_Oct2017.pdf

[iii] Energy Information Administration, Direct Federal Financial Interventions and Subsidies in Energy in Fiscal Year 2013, March 2015, https://www.eia.gov/analysis/requests/subsidy/pdf/subsidy.pdf

[iv] Congressional Research Service memorandum, Energy Tax Provisions, March 27, 2017, http://docs.house.gov/meetings/IF/IF03/20170329/105798/HHRG-115-IF03-20170329-SD002.pdf

[v] Declaration of Independents, http://oilindependents.org/about/

[vi] The Encyclopedia of Earth, The Deep Water Royalty Relief Act, https://editors.eol.org/eoearth/wiki/Deep_Water_Royalty_Relief_Act

[vii] Congressional Record, November 8, 1995, https://www.gpo.gov/fdsys/pkg/CREC-1995-11-08/pdf/CREC-1995-11-08.pdf

[viii] Bureau of Land Management, Frequently Asked Questions About the Federal Coal Leasing Program, https://eplanning.blm.gov/epl-front-office/projects/nepa/64842/78268/88489/CoalFAQ.pdf

[ix] Reuters, U.S. to review energy royalty rates on federal land, March 28, 2017, https://www.reuters.com/article/us-usa-interior-royalties/u-s-to-review-energy-royalty-rates-on-federal-land-idUSKBN1702KC?il=0

[x] Joint Committee on Taxation, Description of Current Law and Select Proposals Related to the Oil and Gas Industry, https://www.jct.gov/publications.html?func=startdown&id=3787