A recent study by analytics firm IHS Markit and co-sponsored by the U.S. Chamber of Commerce shows the importance of our current mix of coal, natural gas, nuclear and renewable energy generating capacity. The report, ‘Ensuring Resilient and Efficient Electricity Generation,[i] found that the current mix of electricity resources is saving our nation $114 billion annually in electricity costs, lowering the cost of electricity by 27 percent. Without significant contributions from nuclear and coal generation, the study found that the price of electricity would increase and the higher prices could lead to the loss of 1 million jobs, the loss of $158 billion to our economy within 3 years and the loss of up to $845 in disposable income for every U.S. household each year.

Study Assumptions and Analysis

The study modeled what the price of electricity would have been between 2014 and 2016 if our nuclear and coal resources were mostly removed from the generating mix. It compared the current mix to a “less efficient diversity” case. That case assumes no meaningful contributions from coal or nuclear resources, a smaller contribution (20 percent less) from hydroelectric resources and a tripling of the current 7 percent contribution from intermittent renewable resources with most of the remaining generation coming from natural gas.

This less efficient diversity case results in little or no reduction in electric sector carbon dioxide emissions because the carbon dioxide emissions profile of the prematurely retiring power supply resources is less than or equal to the emissions profile of the replacement power resources. The report defines a premature retirement to be the shuttering of a power plant with a lower cost to operate than the cost of its replacement.

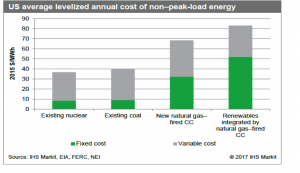

The following figure shows the differences between the going forward costs of existing coal and nuclear power plants and replacement technologies supplying the non-peaking segments of aggregate consumer demand. The replacement cost is for new natural gas combined cycle plants and for a mix of new wind and solar resources integrated by natural gas combined cycle power plants in proportions reflecting the current pipeline of capacity additions. Clearly, the cost of operating an existing plant on average is less than the cost of a new plant whose initial cost of construction still needs to be paid.

According to the authors, “Analyses of the changes in going-forward costs for both coal and nuclear plants show that these costs increase by less than 1 percent per year over the observed age distribution of existing plants. Therefore, the existing cost gaps between the going-forward costs of existing resources and the replacement costs indicate that the typical existing power plant will likely not be economic to retire and replace for another decade or more.”

New England provides an example of increased carbon dioxide emissions due to the premature closure of the Vermont Yankee nuclear power plant. This premature nuclear power plant closure caused carbon dioxide emissions in the Independent System Operator New England to increase by 7 percent from 2014 to 2015. The premature closure of the Pilgrim Nuclear Power Station will likely have a similar impact on regional electricity carbon dioxide emissions. The following figure shows proposed and completed nuclear power plant closures.

The current U.S. electric generating supply is made up of a diverse mix of generating technologies and fuel sources as depicted by the current capacity distribution and the generation shares in the graphs below. The current trend in the U.S. generating sector is toward a greater reliance on natural gas–fired generation and intermittent renewable generation (wind and solar) and a decreased role for hydro, oil, nuclear and coal-fired generation.

Natural gas technologies account for 64 percent of the current electricity capacity addition pipeline, and wind and solar capacity additions account for 29 percent as shown in the figure below. Because the expected utilization rates of the natural gas–fired technologies are more than twice those of the intermittent technologies, the majority of generation in the United States will come from natural gas generating technologies, which will be operating in a net load–following mode to back up and fill in for intermittent wind and solar generation as the generation of hydro, nuclear, coal and oil continues to decrease.

The table below compares the outcomes of the existing U.S generating mix and the less efficient diverse case. All costs were calculated on an unsubsidized basis. The impact of the less diverse case results in an average annual increase of $114 billion in the direct cost of electricity to consumers over the 2013 to 2016 period.

The higher power prices resulting from the less efficient diversity conditions cause negative economic impacts equivalent to a mild recession relative to the GDP of the baseline. The economic impacts result in a decline in real GDP of 0.8 percent, equal to $158 billion (2016 chain-weighted dollars).

Industrial production declines, on average, by about 0.8 percent through year 4, which leads to fewer jobs–a combination of current jobs that are eliminated and future jobs that are never created–within a couple of years relative to the baseline. The largest impact appears in year 2, with 1 million fewer jobs available.

Increases in manufacturers’ costs are ultimately passed on to consumers through higher prices for goods and services. The lower purchasing power results in consumers scaling back discretionary purchases. Real disposable income per household is lower by approximately $845 (2016 dollars) three years after the electric price increase.

Conclusion

Government interference through subsidies and state renewable mandates distorts electricity markets and results in uneconomical choices in capacity mix causing electricity price increases, premature retirements of existing capacity and a less diverse generating technology mix. An analysis of a less diverse generating case between 2013 and 2016 compared to historical norms results in lower GDP, less employment and lower household income.

[i]HIS Markit, Ensuring Resilient and Efficient Electricity Generation, September 2017, https://www.globalenergyinstitute.org/sites/default/files/Value%20of%20the%20Current%20Diverse%20US%20Power%20Supply%20Portfolio_V3-WB.PDF