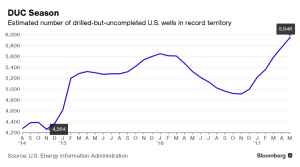

There were 5,946 drilled-but-uncompleted wells in U.S. shale oil fields at the end of May—almost 40 percent more than two and a half years ago.[i] These drilled but uncompleted (DUC) wells will provide new oil supplies when they are completed for consumption later this year and into next year. This U.S. oil boom is clearly a problem for the Organization of Petroleum Exporting Countries (OPEC), who have been limiting oil production in member states and obtaining agreements from some non-OPEC countries to limit output in an attempt to raise oil prices. The influx of American crude, however, is compensating for the OPEC and non-OPEC cuts in oil production, making it difficult to sustain oil prices in the $50 to $60 range. In fact, oil prices are in the $40 per barrel range currently and there are fears it may go below that.

The Shale Oil Drilling Process

The drilling process, which is composed of hydraulic fracturing and horizontal drilling, uses rigs to dig a vertical shaft, dropping 5,000 feet or more. Then a bend in the shaft is used to extend the shaft sideways into a layer of shale. To complete the process, sand, water and some chemicals are pushed under high pressure to release the oil and natural gas, which are pumped to the surface. Until the final step occurs freeing the oil and natural gas, the well is known as a drilled-but-uncompleted asset (DUC) and becomes part of the fracklog.

According to the Energy Information Administration (EIA), U.S. crude oil production averaged 8.9 million barrels per day in 2016. U.S. crude oil production is forecast by EIA in its Short-Term Energy Outlook to average 9.3 million barrels per day in 2017 and 10.0 million barrels per day in 2018. The 2018 forecast exceeds the previous record level of 9.6 million barrels per day set in 1970.[ii] (See graph below.)

Source: https://www.eia.gov/outlooks/steo/

The cost of shale oil drilling has declined due to new systems that make the process more efficient. In some shale plays, like in the Permian Basin, drilling costs have dropped to a breakeven price of about $35 a barrel. As long as crude prices remain above $40, shale drillers will continue drilling new wells and producing crude oil.

OPEC’s Strategy

When the shale oil renaissance began, OPEC decided that its strategy would be to continue producing oil to keep its market share. The result was an oversupply of crude oil, record levels of global oil stockpiles, and falling prices that were as low as $26.05 a barrel on Feb. 11, 2016. At that low price, U.S. oil companies had to reduce operations, cutting jobs, and many went into bankruptcy.

Last fall, OPEC, realizing that its market share strategy wasn’t working, decided to institute voluntary production cuts of 1.2 million barrels per day and to get other oil producers such as Russia to cut production as well. That originally helped to keep oil prices in the low $50 a barrel range, but they have since dropped. On May 25, 2017, OPEC and its partners agreed to extend the oil production cuts that were to expire in June 2017 into the first quarter of next year. After the announcement, oil prices went up, but they have since begun a downward trend. The surge in U.S. shale oil production decreased crude oil prices by more than 16 percent since the beginning of the year. (See chart below.)

Despite the cuts, EIA forecasts OPEC crude oil production will average 32.3 million barrels per day in 2017 and 32.8 million barrels per day in 2018. Some OPEC members (e.g. Libya and Nigeria) are exempt from the cuts.

During the 2011 revolution in Libya and most of the years that followed, oil production was reduced to a trickle and exports were blocked by militias that controlled the ports. Recently, Libya’s oil production hit 885,000 barrels a day–roughly triple its production of a year ago. Libyan oil executives project that their production will reach a million barrels a day by the end of July–a level not seen in four years. Libya has Africa’s largest oil reserves, and its high-quality light crude is in global demand.[iii]

Nigeria is exempt from the OPEC production cuts due to the large volume of oil that was disrupted by militant attacks on pipelines and other infrastructure. Nigeria ramped up its production to 1.73 million barrels per day in May from a low of 1.2 million barrels per day last year and more gains in output are expected.[iv] Platts estimates Nigerian production could increase to 2 million barrels per day by August.[v]

Conclusion

Oil prices may continue to decline unless OPEC digs deeper and cuts oil production even more. U.S. oil production is increasing, compensating for the OPEC oil production cuts, and the excess oil is creating a glut on the market. How long this can last is uncertain because oil prices below $40 a barrel may curtail production from U.S. shale oil producers whose breakeven point is around $35 per barrel.

[i] Bloomberg, Shale’s Record Fracklog Could Force Crude Prices Even Lower, June 19, 2017, https://www.bloomberg.com/news/articles/2017-06-19/shale-s-record-fracklog-could-force-crude-prices-even-lower

[ii] Energy Information Administration, Short-Term Energy Outlook, June 6, 2017, https://www.eia.gov/outlooks/steo/

[iii] New York Times, Libya’s Increased Oil Production Thwarts OPEC’s Reduction Plans, June 20, 2017, https://www.nytimes.com/2017/06/20/business/energy-environment/oil-price-opec-libya.html

[iv] Oil Price, All Eyes On OPEC As Oil Prices Sink, June 23, 2017, http://oilprice.com/Energy/Energy-General/All-Eyes-On-OPEC-As-Oil-Prices-Sink.html

[v] Platts, Nigeria’s cut exemption at risk from oil revival, June 23, 2017, https://www.platts.com/latest-news/oil/london/nigerias-cut-exemption-at-risk-from-oil-revival-26758201