In 2010, fuel cell manufacturer Bloom Energy unveiled its “Bloom Energy Server.” The unveiling and subsequent press attention claimed that these “Bloom Boxes” were green, efficient and represented the future of energy production. But three years later it appears that Bloom Energy’s success can be attributed to savvy PR and government subsidies—not a superior product. After reviewing Bloom’s products in the real world, it appears that not only are Bloom Boxes functionally the same as natural gas power plants, but they are less efficient.

It Started with a Fawning Media

Bloom Energy generated buzz in 2010 after 60 Minutes correspondent Leslie Stahl became the first journalist to tour the Sunnyvale, California headquarters and look inside the top-secret “Bloom Box”. Stahl’s piece, however, was much closer to advertising than journalism. For example, Stahl starts, “In the world of energy, the Holy Grail is a power source that’s inexpensive and clean, with no emissions. Well over 100 start-ups in Silicon Valley are working on it, and one of them, Bloom Energy, is about to make public its invention.”

Stahl, however, leaves out key details about how the Bloom Box works. Bloom Boxes are fuel cells, which are not new technology. The first fuel cell was invented in 1838 and NASA was the first organization to use them commercially in spacecraft. Bloom claims to have invented a new technology that makes its fuel cells more efficient, but the company has not changed the basics of how fuel cells work.

Bloom Boxes, and other similar fuel cells, convert combine methane (ie. natural gas) with oxygen to create an electrochemical reaction that generates electricity and emits carbon dioxide and water. Functionally, this is no different from a regular natural gas power plant—natural gas is in the input and electricity along with carbon dioxide and water vapor are the outputs. In other words, at their core, Bloom Boxes are small natural gas power plants. But instead of converting fuel to electricity through combustion, they convert fuel to electricity through an electrochemical reaction.

60 Minutes failed to explain this critical information about Bloom Boxes—that the boxes are essentially natural gas power plants with the attendant carbon dioxide and water vapor emissions. But 60 Minutes is not alone in not being completely forthright in explaining what Bloom Boxes do.

Apple recently completed a new data center in Maiden, North Carolina. Apple claims “Our Maiden data center is supplied by 100% renewable energy” because Apple gets electricity from an on-site fuel cell installation (of Bloom Boxes) and a solar array (see Apple’s diagram below).

Again, this is marketing hype. While Apple claims their Bloom Boxes produce renewable energy, they admit in the small print that the fuel cell installation “uses directed biogas.” Here is an explanation from GigaOM of what Apple is actually doing:

In Maiden, Apple is selling the power from the fuel cells to the local utility, so it won’t necessarily be using the fuel cell energy onsite to power the data center. The fuel cells will use biogas, and Apple can earn money by selling the power and associated Renewable Energy Credits to Duke. The biogas used will come from landfills, and will be “directed biogas” which means it will be injected into natural gas pipelines and not used directly in the actual fuel cells at the site.

In other words, Apple will purchase biogas from landfills and that biogas will then be put into the regular natural gas transmission network. Apple’s Bloom Boxes will run on natural gas from the regular natural gas transmission network, including regular natural gas and a small amount of biogas.

In Apple’s case, using Bloom Boxes is no different from just buying power from a regular natural gas power plant. But Apple, Bloom and others apparently think it creates positive press to use Bloom Boxes rather than regular natural gas power plants.

Bloom’s good PR extends beyond Apple. A number of well-known companies have purchased Bloom Boxes, including Adobe, FedEx, Staples, Google, Coca-Cola, and Wal-Mart. One reason these companies signed up is because of government subsidies. As 60 Minutes explains, “In California 20 percent of the cost is subsidized by the state, and there’s a 30 percent federal tax break because it’s a ‘green’ technology. In other words: the price is cut in half.” Getting the price cut in half definitely makes expensive energy technology look appealing, especially if it has the veneer of being “green.”

While Bloom Boxes aren’t green (unless you consider natural power plants green), the most important question is whether Bloom Boxes are efficient. According to 60 Minutes, Google has some Bloom Boxes that “use natural gas, but half as much as would be required for a traditional power plant.” The claim that Bloom Boxes are efficient does not stand up to scrutiny.

Is Bloom Green: Unboxing Bloom Energy’s Costs

A couple of engineers in California decided to compare Bloom’s energy efficiency with a cogeneration facility running on natural gas. These two engineers, Bob Spitzka and James Hall, have worked on the feasibility and design of nearly 100 cogeneration facilities and wanted to see how Bloom compared in terms of efficiency. After all, as 60 Minutes noted above, Bloom Boxes received subsidies because they are perceived as “green.”

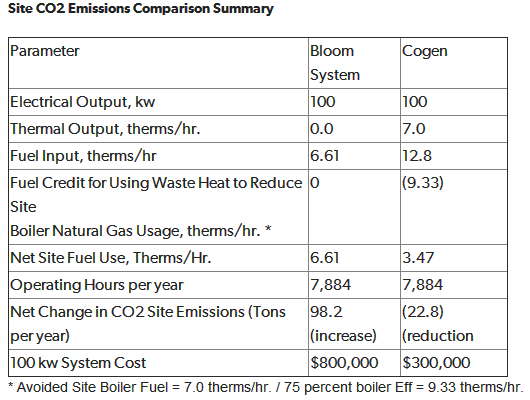

Spitzka and Hall find that conventional cogeneration, which also produces usable heat, can achieve better CO2 reductions than Bloom Energy fuel cells when operating on the same fuel. The following chart compares a cogeneration unit to a Bloom Energy unit, each rated at 100 kw and operating 90 percent of the year:

As the chart shows, a conventional cogeneration unit would cost $500,000 less annually than a Bloom Energy unit. Moreover, the Bloom unit actually increases CO2 emissions by 98.2 tons per year, despite Bloom Energy’s claims that Bloom Boxes are better for the environment. Moreover, cogeneration is nothing new; the technology has existed for more than a century, yet these old units cost less and are more efficient than Bloom Energy’s Bloom Box.

Spitzka and Hall’s paper is not the only examination of Bloom’s efficiency and cost. In 2012, the Santa Clara Valley Transportation Authority (VTA) considered entering into a contract with Bloom Energy to purchase a 400kw Bloom Energy fuel cell facility after receiving a $750,000 grant from the U.S. government (more on that later). VTA would sign a 20-year Purchase Power Agreement with Bloom, which meant VTA would agree to buy power from Bloom, while Bloom would cover installation, operation, and maintenance costs. This type of arrangement would reduce VTA’s up-front costs and minimize risk to the agency.

At the time, Rep. Anna Eshoo (D-Santa Clara) hailed the project, “This funding will help reduce VTA bus emissions in a cost effective way by using new, cutting-edge fuel cell technology, developed right here in California’s 14th Congressional District. A green economy is a healthy economy.”

With a $750,000 grant in hand, and additional $600,000 in subsidies from California Public Utilities Commission, this seems like it should be a done deal. But in March 2013, VTA General Manager Michael Burns advised the VTA Board of Directors to reject the Bloom Energy deal. In his letter, Burns explains the Power Purchase Agreement was “deemed not feasible.” A third-party group was going to provide the financing, but the financiers backed out, leaving the VTA with two options: selling bonds to fund the project, or paying for construction and maintenance of the facility themselves. Burns thought both options were too expensive and risky.

The ill-fated VTA arrangement exposes the real costs of buying Bloom Boxes. According to VTA, a 400 KW system would cost $5.8 million, or $14,500 a KW in capital costs. To put this in perspective, conventional combined cycle natural gas plant only costs $1,017 per KW in capital costs.

Not only are the capital cost high, but Bloom Energy wanted to charge VTA $425,000 per year to maintain the boxes. Lindsay Leveen, a chemical engineer, explains the true cost:

If we assume that the two boxes generate full power for 8,000 hours a year, the amount of power generated is 3.2 million kwh per year. Divide the $425,000 maintenance cost by 3.2 million kwh and we get 13.3 cents per kwh as the cost for maintenance alone. Add to this the cost of natural gas for the inefficient boxes and the payback for the massive investment and power from the Bloom Boxes is well over 30 cents a kwh.

That means the operating costs for VTA’s Bloom Boxes would have produced electricity more than twice as expensive as the average retail price of electricity in California.

Bloom in Delaware

VTA’s experience is backed up by analyzing Delaware’s planned 30 MW Bloom Energy facility. Through a combination of state subsidies and regulatory gimmickry, Delaware Governor Jack Markell and the Delaware Public Service Commission (PSC) struck a deal with Bloom to build a 30 MW fuel cell factory in the state. Delaware funneled $16 million in subsidies to Bloom and allowed Delmarva Power & Light to count the 30 MW of fuel cells it planned to purchase from Bloom toward the state’s renewable energy requirements, even though the fuel cells are powered by nonrenewable natural gas. This led to a lawsuit, filed last year, in which the plaintiffs accuse Markell and the PSC of creating an unfair advantage for Bloom at the expense of ratepayers and competitors. According to the lawsuit:

In return for Bloom’s promise to construct a manufacturing facility in Delaware, the state established a system of discriminatory eligibility requirements, subsidies, and energy-portfolio-standards multipliers that benefit Bloom. These requirements deny out-of-state companies equal competitive footing and increase costs for Delmarva ratepayers who might otherwise benefit from the competitive interstate market.

But more important than even these claims of discriminatory actions by the Delaware government, Bloom had to provide a lengthy application to build its installation in Delaware. When Leveen reviewed Bloom Energy’s application, he found that far from being more fuel efficient and cost effective, the electricity from Bloom Boxes was very expensive and emits more pollution than regular natural gas power plants. He explains:

Buried deep in the permit application, in Table 1 on page 161 of a 163-page application, was the number 884. On that page, under penalty of perjury, Bloom officially told the world that its energy servers emit 884 pounds of carbon dioxide per megawatt hour.

The number 884 reveals that the Bloom boxes are only 45.2% efficient, compared to the full heating value of natural gas. That’s good, but it still means 54.8% of the natural gas energy is “wasted” or not turned into electricity.

It’s certainly not the “over 60% in efficiency” figure that a Bloom marketing director recently presented to a NASDAQ reporter.

…

Also buried on page 161 of the permit application is a Table 2 notation that says these 235 “clean” servers would emit 22.56 pounds of volatile organic compounds (VOCs) per day. But Delaware, like other states, regulates VOC emissions at far lower levels (Maryland, for instance, regulates boat repair shops that emit more than 15 pounds per day). Moreover, if the same amount of power had been generated by combined cycle gas turbines, only 0.249 pounds of VOCs would be emitted daily. That’s 90 times less pollution!

Because of the Bloom servers’ low efficiency and high capital cost, Delaware citizens will pay Bloom over $200 per megawatt hour of power delivered to their PJM grid. But in January 2012 the US Energy Information Agency said the projected “levelized” cost of electricity over the next 30 years from advanced gas-fired combined cycle power stations is $65.50 per MWH. In other words, Bloom plans to charge First State citizens three times the $65 rate, for dirtier power.

Instead of being efficient, green, and affordable, according to Bloom’s application in Delaware, Bloom Boxes emit more pollution and the electricity they generate costs more than three times as much as regular natural gas.

On a broader level, Bloom Energy’s claim to have discovered a revolutionary breakthrough in fuel cell technology should be met with skepticism. Over the 150-year history of fuel cell technology, there has never been a profitable fuel cell company. The four publicly-traded fuel cell companies collectively lost $101.7 million in 2012. As Greentech Media described it, “This is a lackluster, loss-filled business. It’s been like that for decades.” Given this track record, the onus is on Bloom Energy to prove history wrong.

A History of Cronyism

For all of the Bloom Box’s faults, Bloom Energy knows how to tap the taxpayers’ keg. Keen on passing off its inefficient, expensive product as the next green-tech breakthrough, Bloom Energy turned to the State of California for help. In 2010, Bloom Energy collected more than $218 million in subsidies from California’s Self-Generation Incentive Program (SGIP). A subsidy established by California’s Public Utility Commission (CPUC) to bankroll green energy technologies, SGIP awarded two thirds of its $327.7 million fund in 2010 to Bloom Energy. SGIP was supposed to expire at the end of 2011, but since Bloom Energy “sucked up all the money,” as one consumer group put it, the subsidy was extended.

In response, California utility PG&E petitioned the CPUC in December 2010 to suspend payments until the Commission figured out how to disperse the funds more equitably across technologies. That’s when Bloom really flexed its political muscle. With almost $32 million in applications on the chopping block, Bloom board member John Doerr intervened and called the head of the CPUC. A venture capitalist with deep political connections, Mr. Doerr is an adviser to President Obama and longtime Democratic fundraiser who has donated $36 million to California campaigns since 2000. The call resulted in Bloom keeping its subsidies and SGIP keeping the taxpayer dollars flowing.

Not surprisingly, Bloom Energy has also sought federal subsidies. As noted above, last year, Calif. Reps. Anna G. Eshoo (D-Palo Alto), Zoe Lofgren (D-San Jose), and Mike Honda (D-Campbell) announced that the Santa Clara Valley Transportation Authority (VTA) would receive a $750,000 federal grant from the U.S. Department of Transportation to subsidize the purchase of a 400 kw Bloom Energy fuel cell facility.

It is unsurprising to find that since 2007 Bloom Energy executives donated $4,400 to Rep. Eshoo’s reelection campaign, according to public records. The most recent $1,000 check was cut about a month after Rep. Eshoo announced Bloom’s federal grant. Bloom executives also contributed $3,900 to Rep. Lofgren between 2007 and 2011, the vast majority of which came from board member John Doerr.

Bloom Energy is not a newcomer to the crony rodeo. Public records reveal more than $200,000 in political contributions from Bloom Energy executives and board members since the 2008 election cycle.[1] Most of the donations were targeted at politicians from states with renewable electricity mandates, including Illinois, Massachusetts, Rhode Island, New Jersey, Maine, and Washington. Board member John Doerr, venture capitalist at Kleiner Perkins Caufield & Byers, is among the most active contributors, hosting a dinner for President Obama earlier this year and funneling $36 million to California politicians since 2000.

Conclusion

Bloom Energy’s record speaks for itself. Despite attracting hundreds of millions of dollars in taxpayer subsidies, $1.1 billion in venture capital funding, and a laundry list of high-profile clients, the company has never turned a profit in 11 years of operation. The company’s basic claim to have invented a renewable technology that is cost competitive does not stand up upon closer examination. As the Santa Clara episode shows, Bloom Energy has a habit of promising lemonade but delivering lemons, generally around the time of an initial public offering (IPO). When Bloom Energy is confronted with the inescapable fact that the natural gas on which the Bloom Box depends is not a renewable resource, the company banks on its political ties to game the system, as it did in Delaware. Until Bloom Energy proves otherwise, the company should be viewed as nothing more than the latest green-tech to over-promise and under-deliver.

IER Policy Associate Alex Fitzsimmons co-wrote this post.

[1] According to OpenSecrets.com, Bloom board member John Doerr donated $183,400 since the 2008 election cycle. Employees of Bloom Energy donated 32,500.