If you are looking for a report that provides a comprehensive overview of today’s electricity markets, the principal causes of coal and nuclear retirements and the issues surrounding electric grid reliability and resilience, check out the Department of Energy’s Staff Report to the Secretary on Electricity Markets and Reliability. The grid study identifies low-cost and abundant natural gas as the main contributor to coal and nuclear plant retirements, but also notes other factors that include relatively flat electric demand, environmental regulations and the growth of intermittent renewable energy that is heavily subsidized. According to the report, renewable energy negatively affects the economics of baseload power plants, primarily due to “wholesale market impacts and distortions” from state renewable portfolio standards and federal tax credits for wind and solar.

The report makes eight recommendations, including directing the Federal Energy Regulatory Commission (FERC) to expedite the study of wholesale market structures; promoting research and development for grid resilience, reliability, modernization and renewables integration technologies; and examining infrastructure permitting and regulatory processes. It recommends that FERC accelerate efforts to improve energy price formation in wholesale power markets and create fuel-neutral markets that adequately compensate resources for essential reliability services to the grid.

The study recommends that federal agencies expedite permitting for hydroelectric, coal and nuclear power plants. It encourages the Nuclear Regulatory Commission to ensure the safety of existing and new nuclear facilities without unnecessarily adding to the operating costs and economic uncertainty of nuclear energy. And it encourages the Environmental Protection Agency to allow coal-fired power plants to improve efficiency and reliability without triggering new regulatory approvals and associated costs.

The following sections provide a snapshot of some of the contents of the report. The report is voluminous and contains much more material than what is summarized here.

Coal Retirements

One impetus for the report was the premature retirement of generating capacity, driven by a number of factors that include economics, federal and state regulation and state policies such as mandating the construction of renewable generating units by specified dates.

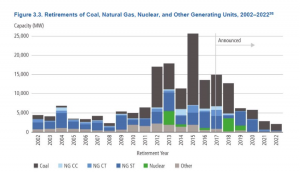

Between 2002 and 2016, 531 coal generating units representing approximately 59,000 megawatts of generation capacity retired from the U.S. generation fleet. According to the study, the largest amount of generating capacity was retired in 2015, which coincided with the compliance deadline for the Mercury and Air Toxic Standard rule and finalization of the Clean Power Plan—both heavily impacting the retirements of coal-fired capacity due to the cost of compliance of adding pollution control equipment. In 2015, coal-fired power plants made up more than 80 percent of the 18,000 megawatts of electric generating capacity that retired. (See graph below.)

The study notes that the primary drivers of recent coal plant retirements include low natural gas prices and environmental regulations—especially the Mercury and Air Toxics Standard (MATS), Clean Water Act Section 316(b), and the Coal Combustion Residuals rule. Other contributing factors include more competitive markets and a variety of regional and state-level policies involving renewables and carbon pricing.

Most of the coal-fired power plants being closed today were built in the 1940s, 1950s and 1960s, before the Clean Air Act was passed in 1970; they have minimal air pollution controls. Because much of the older capacity tends to be smaller units (less than 300 megawatts), which are not economical to retrofit, they are being retired rather than updated to comply with the new regulations. Now that the MATS deadlines have passed, additional coal-fired retirements are due to economics, renewable energy mandates and subsidies, reduced or low demand for electricity and the Clean Power Plan.

Source: Department of Energy

Nuclear Retirements

Nuclear power is also affected by regulation, particularly due to the Cooling Water Intake Rule. The owners of three nuclear power plants (Oyster Creek, Diablo Canyon and Indian Point) cited disputes with their respective states, which implement the rule, as one of the reasons for retiring the plants.

Market structure is also a significant factor in power plant retirements, particularly the timing of retirements. Merchant plants composed the majority of retired capacity (almost 70 percent) between the years of 2002 and 2010. Merchant plants were created by state electric restructuring plans.

Twenty-eight of our nuclear plants are merchant plants that were spun off by vertically integrated electric utilities under state electric restructuring in the early 2000s. Merchant units operate in centrally-organized wholesale markets. At the time of the spin-off, the nuclear units were economic in the wholesale markets due to high natural gas prices, but current low-cost natural gas has made it difficult for these plants to compete. Some nuclear plant retirements are occurring even before their operating licenses expire because of lower revenues rather than higher operating costs, as wholesale electricity prices have precipitously fallen over the last several years.

The remaining nuclear plants in our electric fleet are owned by vertically integrated electric utilities, which rely on regulated cost-of-service ratemaking that provides a stable source of cost recovery, assuming reasonably prudent operation and management by the utility. The continued operation of these units depends on decisions by their ratemaking authorities, which may include economics or other issues.

Between 2002 and 2016, 4,666 megawatts of nuclear generating capacity were announced for retirement, or approximately 4.7 percent of the U.S. total. Another eight reactors representing 7,167 megawatts of nuclear capacity (7.2 percent of U.S. nuclear capacity and 0.6 percent of total U.S. generating capacity) have announced retirement plans since 2016.

Natural Gas Now the Preferred Choice

Natural gas combined cycle units accounted for 54 percent of the 447,000 megawatts of total U.S. natural gas-powered generator capacity in 2016. Combined-cycle generators have been a popular technology choice since the 1990s and made up a large share of the capacity added between 2000 and 2005.

Source: Department of Energy

Until recently, most natural gas combined cycle units were used for intermediate and peak loads rather than baseload. However, because natural gas prices have been low for a sustained period, and because these plants retain some of the flexible characteristics of combustion turbines and operate at a higher efficiency and lower cost, they are being used for baseload power. As a result, some coal-fired plants have been pushed higher on the merit order, which reduces their average capacity factors and negatively impacts their economics.

Growing Renewable Energy Deployment

Wind and solar PV have constituted the vast majority of renewable energy deployed in recent years. Wind first surpassed 1 percent of total U.S. generation in 2008, while total solar generation reached that threshold in 2015. Total end-use demand served by wind generation tripled from 1.5 percent in 2008 to 4.5 percent in 2013. Total renewable generation now exceeds 14 percent, with hydro and wind comprising the largest components.

The deployment of wind and solar power has been spurred by a combination of technology cost declines; state Renewable Portfolio Standards (RPS); private sector sustainability goals; consumer choice; Federal and state incentives; transmission expansion; and Federal and state environmental, air quality, and greenhouse gas emissions reductions policies.

RPSs in 29 states and the District of Columbia, covering 55 percent of total U.S. retail electricity sales, have been substantial drivers of renewable energy growth, providing 60 percent of the generation growth since 2000. Though wind has historically been the largest beneficiary of RPS policies, more RPS-driven solar than wind was added in 2015.

Federal subsidies through the investment tax credit (ITC) and the production tax credit (PTC) have driven expansion of wind and solar power. The following figure shows the substantial increase in wind capacity since 1998 and the impact of the PTC. It shows the wind industry’s tendency to increase investments in years when the tax credit was due to expire and its extension was uncertain. The current PTC is scheduled to be phased out after 2019. The solar ITC—currently at 30 percent—will be reduced after 2021 to its statutory level of 10 percent for commercial and industrial projects and will be phased out completely for residential projects.

Source: Department of Energy

Besides encouraging the deployment of wind and solar power, the PTC and the ITC have affected the operation of traditional plants. For example, the wind PTC allows wind units to operate at a negative price since they receive a production tax credit for their first 10 years of their operation that has been as high as 2.3 cents per kilowatt hour.

Reliability and Resilience

Reliability is a function of adequacy and operating reliability. Adequacy is the ability of the electric system to supply the aggregate electric power and energy requirements of the electricity customers at all times, taking into account scheduled and reasonably expected unscheduled outages of system components. Operating reliability is the ability of the electric system to withstand sudden disturbances to system stability or unanticipated loss of system components.

Infrastructure resilience is the ability to reduce the magnitude and/or duration of disruptive events. The effectiveness of a resilient infrastructure or enterprise depends upon its ability to anticipate, absorb, adapt to and/or rapidly recover from a potentially disruptive event. Examples of events that test a system’s resilience include severe natural events (wildfires, hurricanes, floods, droughts and earthquakes) and coordinated, extensive physical and cyber-attacks and geomagnetic disturbances.

The report found that markets recognize and compensate reliability and must continue to do so, but work is needed to address resilience. According to the North American Electric Reliability Corporation, reliability issues that continue to require attention include maintaining essential reliability services as conventional generation retires and ensuring flexibility and sufficient transmission to supplement and offset renewable energy.

Resilience issues include having sufficient fuel in case of severe weather or other disruptions that have plagued the system in the past (such as natural gas shortages in the Northeast due to lack of infrastructure). Recent severe weather events have demonstrated the need to improve system resilience. Resilience-enhancing resource attributes, including fuel assurance, need to be recognized. For example, on-site coal piles and nuclear plants that can run for months on nuclear fuel in their cores provide fuel assurance, while natural gas plants are dependent on just-in-time deliveries from gas pipelines.

An area of further study noted in the report is the exploration the of costs and benefits of states applying cost-of-service regulation to specific at-risk plants that contribute to grid resilience. As mentioned earlier, in wholesale markets, these at-risk plants may not be able to recoup their generating costs, especially capital investments needed for long-term reliability, but may have other beneficial attributes such as contributing to meeting state emission reduction standards.