Green technologies (e.g., wind, solar and electric vehicles) cannot compete in the marketplace without subsidies or other favorable government policies.

In Nevada, for example, when the government modified its policy to pay customers less for excess power produced by rooftop solar systems, solar installers left the state for others providing more favorable net metering policies. With its solar installations down, Nevada’s legislature recently passed a net metering bill, which the Governor is expected to sign, that brings back net metering at a slightly discounted rate.

The reason the state removed net metering was that solar rooftop customers received free transmission access, forcing non-rooftop solar customers to pay for the transmission services of the solar customers. Net metering is a regressive policy because most rooftop solar customers are higher income households. Nevada’s electric utility company, NV Energy, indicated that restoring net metering under an earlier version of the revised policy would be expensive—over $63 million each year, or about $1.3 billion over two decades.[i]

Besides net metering, many states have renewable portfolio standards that require a certain percentage of their generation to come from renewable energy by a specified date. These state measures—along with federal government subsidies such as the production tax credit for wind, the investment tax credit for solar and the tax credit for purchasing electric vehicles—provide lasting incentives that are pushing green technologies into the U.S. marketplace. These technologies would not have grown to today’s levels without these incentives. It is important to realize that the incentives are costing consumers and taxpayers more than the alternatives would.

Nevada Reinstates Net Metering

Nevada’s new bill (AB 405), if signed, will allow rooftop solar customers to be reimbursed for excess generation beginning at 95 percent of the retail electricity rate. Over time, the customers’ compensation would decline to a floor of 75 percent of the retail rate. If signed by the Governor, the bill would create four tiers, where credit rates decrease in 7 percent increments for every 80 megawatts of rooftop solar. Since 80 megawatts of solar panels can be deployed in each tier, it is expected to take years to reach the 75 percent floor. In Nevada’s largest solar installation year the state deployed around 100 megawatts of rooftop solar.

AB 405 allows net-metered customers to lock in their rate for at least 20 years, which is another feature of many renewable energy incentives. The bill contains several consumer protections such as a requirement that solar companies offer a 10-year warranty and provide transparent information so that consumers can calculate their savings. The legislation also ensures that net metering will continue even if Nevada decides to deregulate the state’s electricity market. And, the bill mandates that residential solar and energy storage customers cannot be treated as a separate rate class, eliminating the option of instituting higher fees.

If Governor Brian Sandoval signs the bill, the net metering compensation changes would take effect immediately, and the consumer protection measures would take effect this fall.

Federal Renewable Subsidies

The federal Production Tax Credit (PTC) for wind provides a tax credit for wind units during their first ten years of operation. It has expired and extended 10 times and is now set to expire at the end of 2019. This year, the subsidy is 20 percent less than its level last year of 2.3 cents per kilowatt-hour. In 2018, it will be 40 percent less, and in 2019, 60 percent less.[ii] The credit is so lucrative that wind operators can, and sometimes do, accept a negative price during periods of low demand in order to wipe out the competition. According to a Congressional Research Service study, the PTC is the largest 2016 to 2020 energy-related tax expenditure cost to the Treasury at $25.7 billion.[iii]

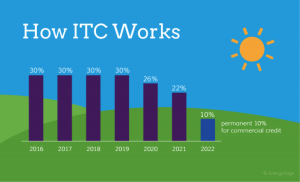

The Investment Tax Credit (ITC) for solar provides a federal tax deduction of 30 percent from the cost of installing a solar energy system. The credit applies to both residential and commercial systems. The 30 percent ITC was originally established by the Energy Policy Act of 2005 and was set to expire at the end of 2007. Like the PTC, Congress has extended its expiration date several times and it now sunsets in 2021 for residential customers with reduced tax credits. From 2016 through 2019, the tax credit remains at 30 percent of the cost of the system. In 2020, the deduction is reduced to 26 percent and in 2021, the deduction is 22 percent of the cost of the system. In 2022 and thereafter, only owners of new commercial solar energy systems can receive a credit, which is 10 percent of the cost of the system.[iv]

Source: https://www.energysage.com/solar/cost-benefit/solar-investment-tax-credit/

The federal tax credit for electric vehicles is based on battery size and can be as large as $7,500. It is given to the purchaser of the vehicle and to the manufacturer if it is a leased vehicle. The electric vehicle tax credits are phased out as sales volume increases. The expiration date differs by manufacturer and comes only after an auto manufacturer sells 200,000 qualified vehicles, which no manufacturer has achieved yet. The following table provides a list of tax credits for some popular models as of April 2017.[v]

| Electric Vehicles | Federal Tax Credit |

| BMW i3 | $7,500 |

| Chevrolet Bolt | $7,500 |

| Fiat 500e | $7,500 |

| Ford Focus Electric | $7,500 |

| Hyundai Ioniq Electric | $7,500 |

| Kia Soul EV | $7,500 |

| Mercedes-Benz B-Class EV | $7,500 |

| Nissan Leaf | $7,500 |

| Tesla Model S | $7,500 |

| Tesla Model X | $7,500 |

| Plug-In Hybrids | Federal Tax Credit |

| Audi A3 e-tron | $4,205 |

| BMW i3 (with range extender) | $7,500 |

| BMW i8 | $3,793 |

| Chevrolet Volt | $7,500 |

| Chrysler Pacifica | $7,500 |

| Ford C-Max Energi | $4,007 |

| Ford Fusion Energi | $4,007 |

| Hyundai Sonata Plug-In Hybrid | $4,919 |

| Kia Optima Plug-In | $4,919 |

| Toyota Prius Prime | $4,502 |

| Volvo XC90 T8 | $4,585 |

Source: https://www.edmunds.com/fuel-economy/the-ins-and-outs-of-electric-vehicle-tax-credits.html

Despite these lucrative tax credits and state renewable programs, the penetration of green technologies has been limited. Wind generates only 5.6 percent of our electricity, utility scale solar less than 1 percent. Rooftop solar systems provide another half of a percent based on estimates of the Energy Information Administration. And, despite former President Obama’s desire to have 1 million electric vehicles on the road in 2015, less than half that number was achieved. While sales of electric vehicles continue, through November 2016, only 542,000 electric vehicles were sold in the United States.[vi]

Globally, the number of electric vehicles on the road in 2016 was 2 million, according to the International Energy Agency (IEA). China, the United States and Europe make up the three main markets, totaling more than 90 percent of all electric vehicles sold. China alone accounted for over 40 percent of the electric vehicles sold in 2016. In Europe, Norway had the highest share of the electric vehicle market at 29 percent, followed by the Netherlands with 6.4 percent, and Sweden with 3.4 percent.[vii] In terms of the total market, however, electric vehicles made up only 0.2 percent of total passenger light-duty vehicles on the road in 2016. According to the IEA, in order to limit temperature increases to below 2°C by the end of the century, the number of electric cars will need to reach 600 million by 2040—a factor increase of 300.[viii]

Conclusion

There are many lucrative subsidies and government programs for green technologies—several of which have been highlighted above. These programs cost consumers and taxpayers more than the alternatives available to the market place and often are regressive policies, particularly in the case of rooftop solar systems and electric vehicles which are purchased by higher income consumers, who can afford them.

[i] Greentech Media, Nevada Legislature Passes Bill to Restore Net Metering for Rooftop Solar, June 5, 2017, https://www.greentechmedia.com/articles/read/nevada-bill-to-restore-net-metering-for-rooftop-solar-passes-in-the-senate?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+GreentechMedia+%28Greentech+Media%29

[ii] Department of Energy, Renewable Electricity Production Tax Credit, https://energy.gov/savings/renewable-electricity-production-tax-credit-ptc

[iii] Congressional Research Service, March 27, 2017, http://docs.house.gov/meetings/IF/IF03/20170329/105798/HHRG-115-IF03-20170329-SD002.pdf

[iv] Energy Sage, Investment Tax Credit for Solar Power, https://www.energysage.com/solar/cost-benefit/solar-investment-tax-credit/

[v] Edmunds, Electric Vehicle Tax Credits, March 29, 2017, https://www.edmunds.com/fuel-economy/the-ins-and-outs-of-electric-vehicle-tax-credits.html

[vi] Recode, There have now been over 540,000 electric vehicles sold in the U.S., December 21, 2017, https://www.recode.net/2016/12/21/14041112/electric-vehicles-report-2016

[vii] International Energy Agency, Electric vehicles have another record year, reaching 2 million cars in 2016, June 7, 2017, https://www.iea.org/newsroom/news/2017/june/electric-vehicles-have-another-record-year-reaching-2-million-cars-in-2016.html

[viii] Ibid.