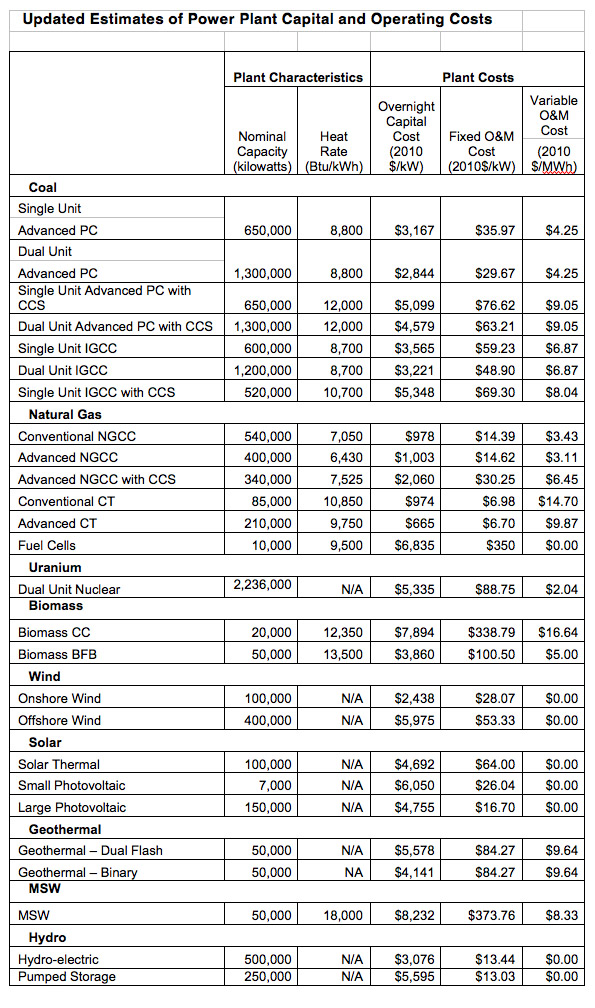

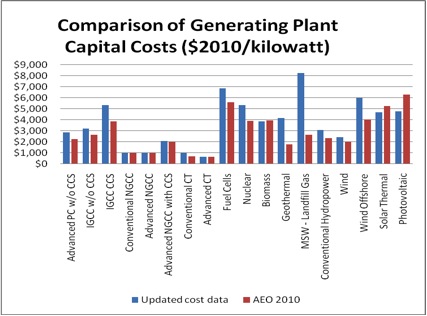

The Energy information Administration models the supply and demand for energy and publishes the results each year in its Annual Energy Outlook (AEO). In order to represent the electric generating sector and to forecast which generating technologies are likely to be constructed in the future, the agency needs estimates of the cost of current and future generating technologies. Periodically, it updates this information based on the costs of the most recent plants built, the technologies and their costs in the construction pipeline, and the anticipated technological advances in the generating sector. The agency just released its assessment of electricity generating technology construction capital costs , finding the capital costs of coal-fired, nuclear, wind, hydropower, geothermal, and municipal solid waste and landfill gas technologies to be higher than their previous estimates; the capital costs of natural gas and biomass technologies to be about the same; and the capital costs of solar technologies to be lower than the prior estimates. In particular, they found:

• Coal-fired plant capital costs are higher by 23 to 39 percent over prior estimates, with pulverized coal (PC) 25 percent higher and integrated gasification and combined cycle (IGCC) 23 percent higher. The 39 percent increase is for coal plants with carbon capture and sequestration (CCS) technology. The higher cost estimates include the rising costs of capital intensive technologies in the power sector, higher global commodity prices, and few construction firms with the ability to complete complex engineering projects.

• Nuclear plant capital costs are higher by 37 percent and are based on the same factors as coal plants.

• Natural-gas fired plant capital costs are about the same as previous estimates for combined cycle (NGCC) units and advanced combustion turbines (CT). Fuel cell capital costs are 22 percent higher.

• Geothermal plant capital costs are 132 percent higher and are highly site-specific.

• Municipal solid waste (MSW) and landfill gas plant capital costs are 210 percent higher.

• Conventional hydropower capital cost is 53 percent higher.

• Onshore wind capital cost is 21 percent higher and is based on a new plant with all owners costs included; offshore wind capital cost is 49 percent higher and the methodology recognizes the differences of constructing offshore wind units in the United States versus Europe with its unique infrastructure.

• Biomass plant capital cost is about the same as the previous estimate.

• Solar photovoltaic technology capital cost is 25 percent lower than the previous estimate and solar thermal capital cost is 10 percent lower. The decrease in the cost of solar photovoltaics is due to falling component costs and larger scale facilities.

The costs are overnight capital costs, which represent the cost of constructing the plant “overnight”, and as such do not include financing costs. The impact of these new cost assumptions in terms of future generating capacity and levelized generating costs will be realized when EIA publishes its latest forecasts in the Annual Energy Outlook (AEO) 2011.

Source: EIA, http://www.eia.gov/oiaf/beck_plantcosts/pdf/updatedplantcosts.pdf

Source: EIA, http://www.eia.gov/oiaf/beck_plantcosts/pdf/updatedplantcosts.pdf

[i]Energy Information Administration, Updated Capital Cost Estimates for Electricity Generation Plants, November 2010, http://www.eia.gov/oiaf/beck_plantcosts/pdf/updatedplantcosts.pdf

[ii] Energy Information Administration, Updated Capital Cost Estimates for Electricity Generation Plants, November 2010, http://www.eia.gov/oiaf/beck_plantcosts/?src=email