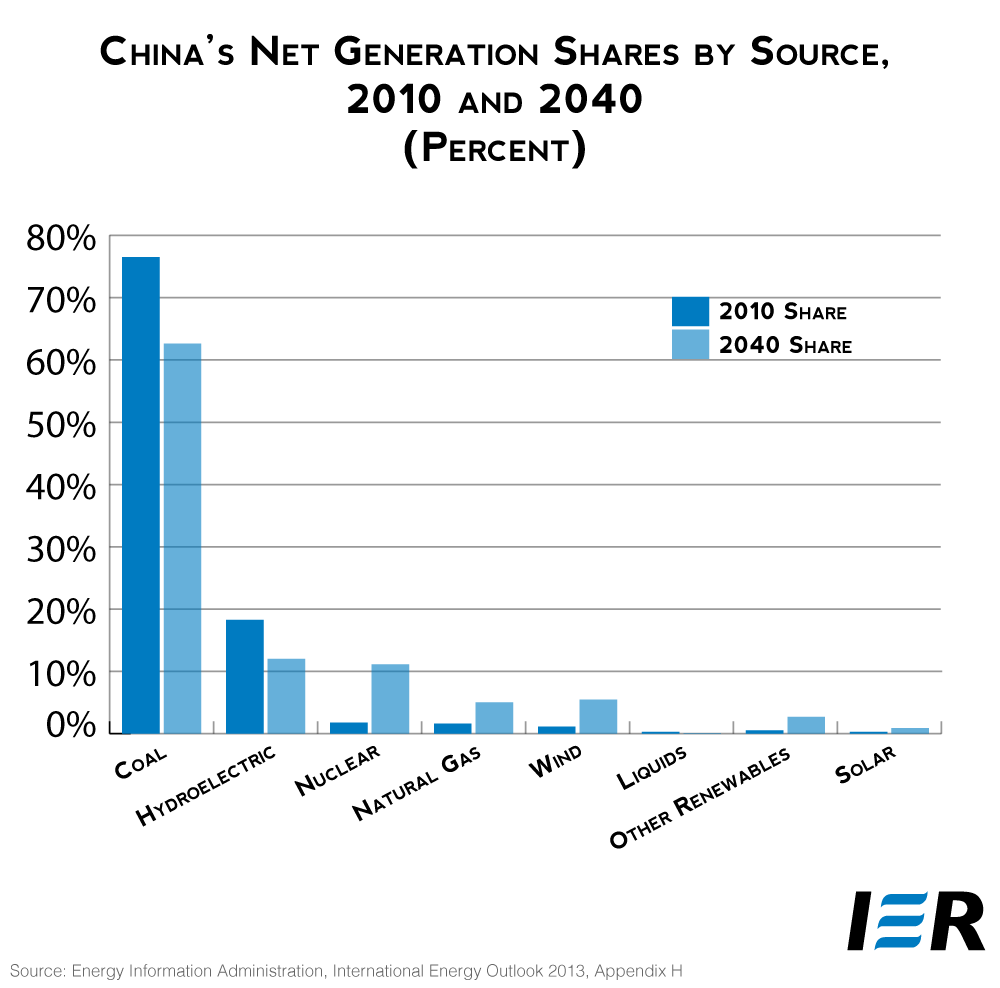

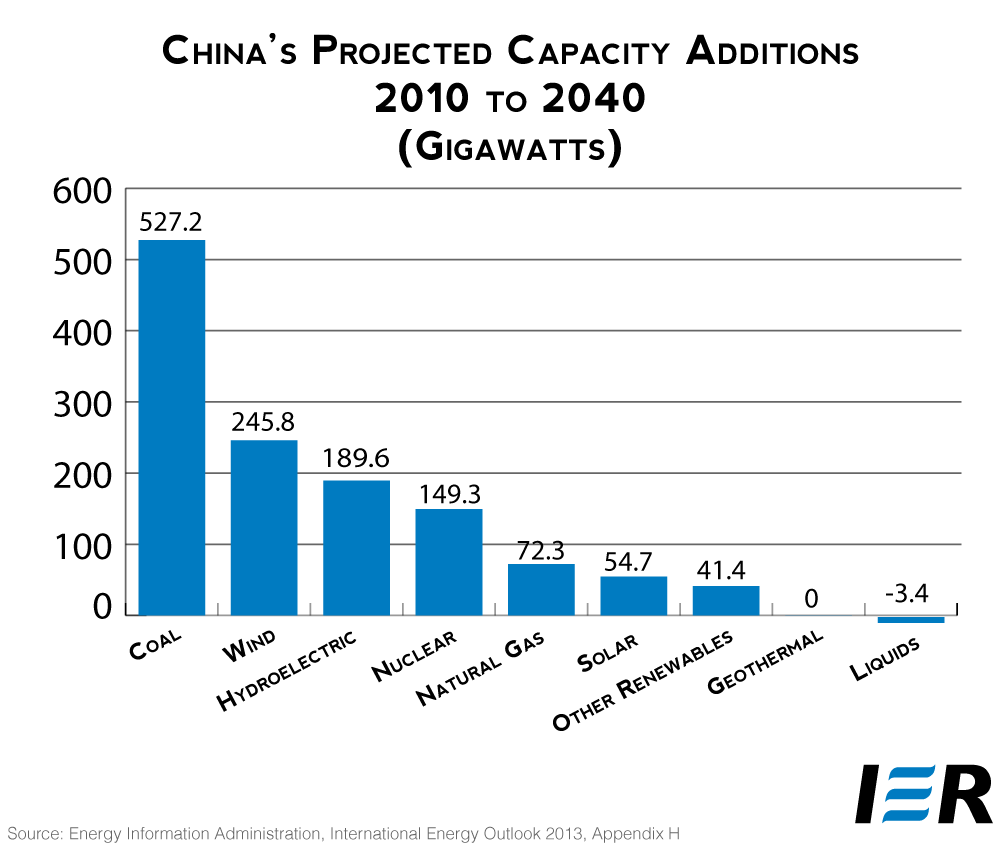

The Energy Information Administration (EIA) in its International Energy Outlook 2013 projects that China will remain dependent on coal as its major generating technology through 2040 via the construction of 527 gigawatts of new coal-fired generating capacity over the 30 year projection period, almost doubling its current coal-fired generating capacity. In 2010, China generated 77 percent of its electricity using coal; by 2040, EIA projects that coal’s share of China’s generating market will drop to 63 percent, but that it will still remain the major supplier of electricity in the country. (See graph below.)

Hydroelectric power also loses share in China’s generating market, from 18 percent in 2010 to 12 percent in 2040 despite adding 190 gigawatts of hydroelectric generating capacity. Hydro still remains the second largest generator in 2040, followed by nuclear power. China is expected to add 149 gigawatts of nuclear capacity over the 30-year projection period. Wind increases its share in the Chinese electric generating market with an additional 246 gigawatts being constructed by 2040, but its 2040 generation share is at only 5.5 percent, up from 1.1 percent in 2010. China is constructing more than twice as much coal capacity than wind capacity over the 30 year projection period.

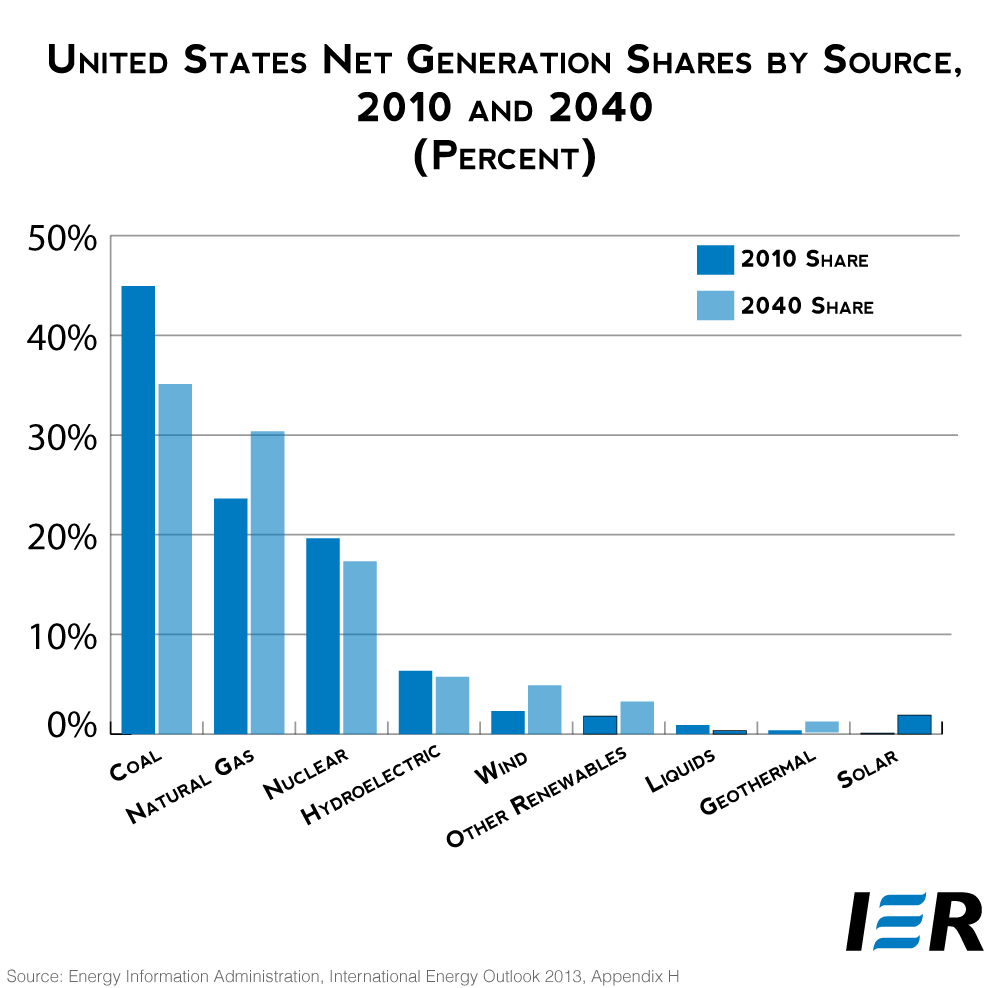

In contrast, the United States relies less on a single source for its electricity generation. EIA projects that the United States will get the majority of its generation from coal-fired and natural gas-fired generating technologies in 2040, followed by nuclear power. Coal’s share of the U.S. generation market drops from 45 percent in 2010 to 35 percent in 2040, while the natural gas share increases from 24 percent in 2010 to 30 percent in 2040. Nuclear power’s share in the United States drops from 20 percent in 2010 to 17 percent in 2040. Similar to China’s generating market, hydroelectric and wind power are the 2 largest renewable sources in the U.S. electric generation market. But, hydroelectric power decreases its share in U.S. markets from 6.3 percent in 2010 to 5.7 percent in 2040, while wind power increases its share from 2.3 percent in 2010 to 4.9 percent in 2040.

Source: Energy Information Administration, International Energy Outlook 2013, Appendix H

EIA’s China Outlook

China has been among the world’s fastest growing economies for the past two decades. From 1990 to 2010, China’s economy grew by an average of 10.4 percent per year. Although economic growth in China remained strong through the global recession, its rate had slowed. In 2012, real GDP in China increased by just 7.2 percent, its lowest annual growth rate in 20 years. The IEO 2013 forecast assumes that China’s real GDP will grow at an average rate of 5.7 percent per year through 2040. That is a faster growth than the average assumed for the world’s real gross domestic product (expressed in purchasing power parity terms), which rises by an average of 3.6 percent per year from 2010 to 2040.

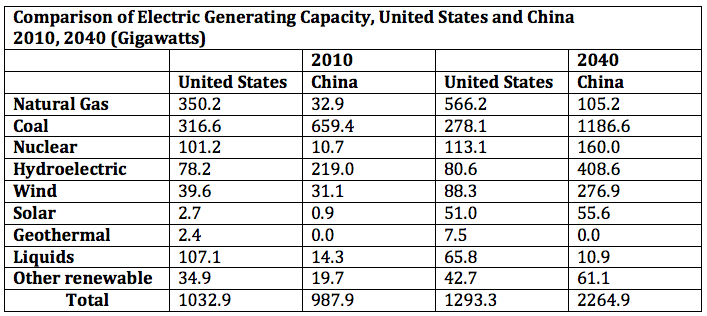

To fuel its economic growth, China more than doubles its energy consumption between 2010 and 2040 from 101 quadrillion Btu in 2010 to 220 quadrillion Btu in 2040. In 2010, China used 3.4 percent more energy than the United States used, but is expected to more than double U.S. energy demand by 2040. For example, China’s coal generation capacity is already over twice that of the United States, and its hydroelectric generation is nearly three times the size of its counterpart in the United States, but by 2040, coal capacity in China will be four times that of the United States while its hydroelectric capacity will exceed five times that of the United States.

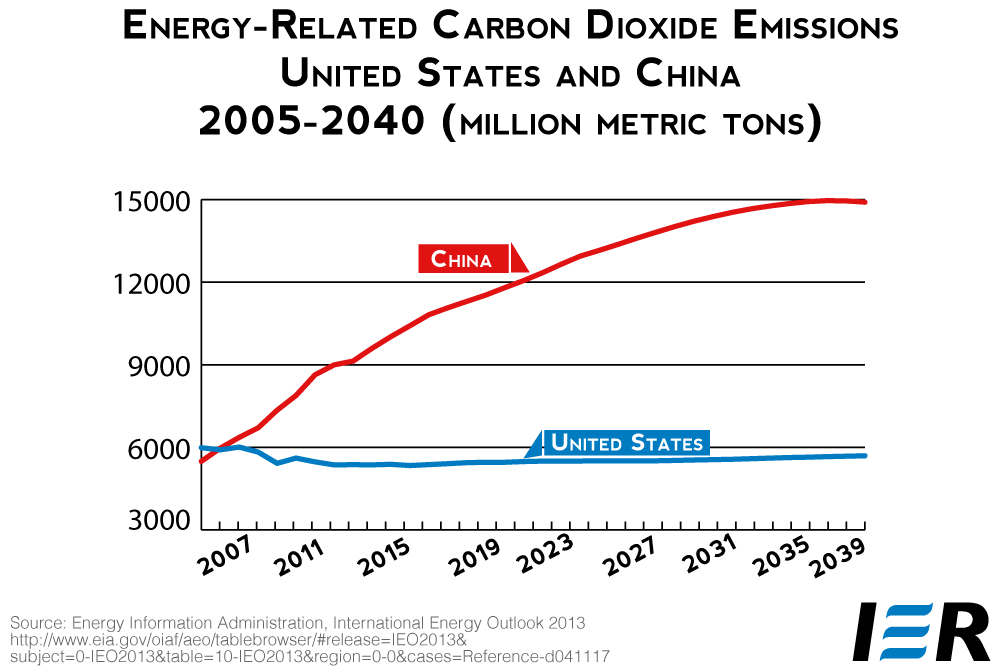

As a result, based on current policies and regulations, China is expected to increase its annual energy-related carbon dioxide emissions by more than 7 billion metric tons between 2010 and 2040 (an 89 percent increase). China became the largest emitter of carbon dioxide emissions in 2007, surpassing the United States. In 2010, China’s energy-related carbon dioxide emissions were 41 percent higher than that of the United States. In 2040, they are expected to be 162 percent higher than the energy-related carbon dioxide emissions projected for the United States, and 7 percent higher than the energy-related carbon dioxide emissions projected for all the countries making up the Organization for Economic Cooperation and Development.

Natural Gas Expectations

The IEO2013 projects a substantial increase in tight gas, shale gas, and coalbed methane. In the United States, increased natural gas production has been advanced by the application of horizontal drilling and hydraulic fracturing technologies, which made it possible to develop the country’s vast shale gas resources and contributed to a near doubling of total U.S. technically recoverable natural gas resource estimates over the past decade. In 2040, shale gas accounts for 50 percent of U.S. natural gas production. In China, tight gas, shale gas, and coalbed methane resources account for more than 80 percent of its total domestic production in 2040. The IEO predicts that natural gas consumption in China will increase by 360 percent from 3.8 trillion cubic feet in 2010 to 17.5 trillion cubic feet in 2040. While 40 percent less than natural gas consumption in the United States in 2040, it is a sizable increase from China’s current natural gas consumption.

Although liquefied natural gas trade has grown at a faster rate than pipeline trade worldwide in recent years, pipeline transportation of natural gas remains an integral part of world natural gas trade in the IEO2013. The IEO outlook includes several new long-distance pipelines and expansions of existing infrastructure, including large volumes of pipeline flows into China from both Russia and Central Asia.

Coal Demand and Production

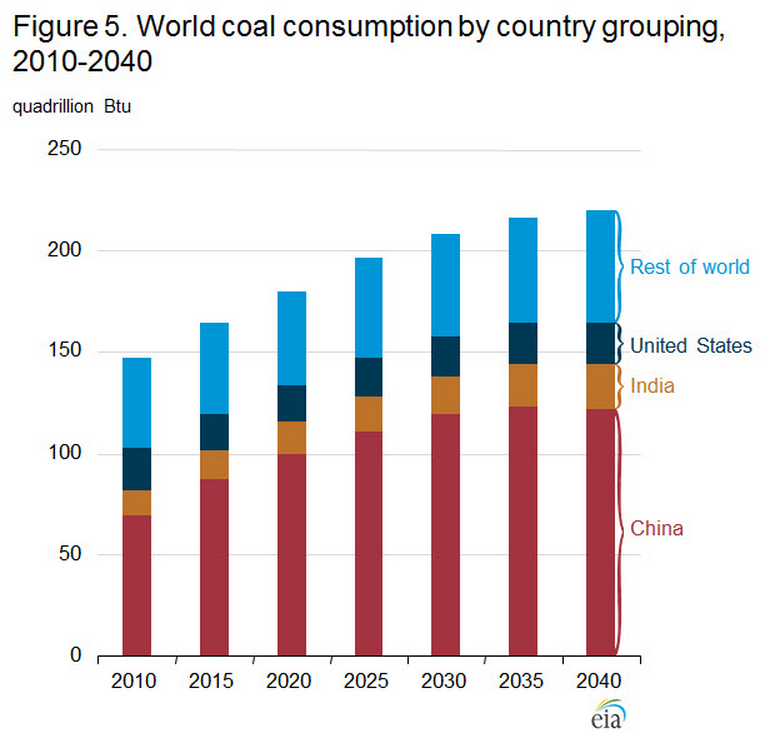

The near-term expansion of coal consumption in the IEO reflects significant increases in coal consumption in China, India, and other developing countries. In the longer term, growth of coal consumption decelerates as policies and regulations encourage the use of cleaner energy sources, natural gas becomes more economically competitive as a result of shale gas development globally, and growth of industrial use of coal slows, largely as a result of China’s industrial activities. Coal consumption in the Outlook is dominated by China (47 percent) and the United States (14 percent). Including India, these three countries account for 70 percent of total world coal consumption in 2010. Their share of world coal use increases to 75 percent in 2040. In 2010, China consumed 3.3 times as much coal as did the United States; by 2040, China is expected to consume 6 times as much coal as the United States is expected to consume.

Source: Energy Information Administration, International Energy Outlook 2013, http://www.eia.gov/forecasts/ieo/more_highlights.cfm

Global coal production is concentrated among four countries—China, the United States, India, and Australia—and in the other countries of developing Asia. The combined share of total world coal production from these 4 countries increases in the IEO2013 from 78 percent in 2010 to 81 percent in 2040. China accounted for 44 percent of global coal production in 2010, and its share peaks at 52 percent in 2030. There is sustained growth in coal production in China over the forecast period, compared to limited growth in the United States.

Transportation Energy Use

Energy use in the transportation sector includes the energy consumed in moving people and goods by road, rail, air, water, and pipeline. A strong increase in the demand for transportation fuels, particularly in the developing economies, where income growth and demand for personal mobility, combined with rapid urbanization, has the greatest impact on growth in world transportation energy use, keeps world oil prices high throughout the projection period. China leads the projected global growth in transportation liquids demand, more than tripling its consumption from 8 quadrillion Btu in 2010 to 26 quadrillion Btu by 2040. China’s transportation energy use was only one-third of that in the United States in 2010; by 2040, China is projected to consume about the same amount of energy for transportation as the United States.

Conclusion

In the latest International Energy Outlook, EIA is forecasting that China will be the major contributor to energy demand, coal consumption and production, and energy-related carbon dioxide emissions through 2040. China is also projected to be the largest economy in the world by 2017. The country has clearly taken steps to ensure that it has the energy needed to fuel its economic growth. And, despite the interests of the developed world in wanting China to use renewable fuels, it will be dependent on coal for a long, long time, emitting a third of the world’s energy-related carbon dioxide emissions in 2040, according to the EIA.