A number of reports recently have indicated that the oil and gas industry is responsible for a major increase in employment. The Energy Information Administration (EIA), using data from the Bureau of Labor Statistics, noted that between the beginning of 2007 and the end of 2012, jobs in the oil and gas industry increased by 40 percent, while jobs in the private sector increased just 1 percent. IHS CERA Consulting just released a study touting the increased jobs that have resulted from booming oil and gas production in the United States, spurred by developments in drilling technology. According to the study, the boom created 2.1 million direct and indirect jobs by the end of last year and that number is expected to increase to almost 3.9 million jobs by 2025.

But, the job increase is not the only good news. According to the IHS study, the energy boom added almost $75 billion in federal and state revenues, which could reach over $125 billion by 2020, and contributed $283 billion to the gross domestic product in 2012, which is expected to increase to almost $533 billion annually beginning in 2025. These new sources of domestic oil and natural gas added more than $1,200 to the discretionary income of the average U.S. family last year, and that number is expected to increase to $2,000 per household per year by 2015 and $3,500 by 2025. The use of hydraulic fracturing and horizontal drilling technology in oil and natural gas drilling sparked more than $120 billion in U.S.-based investment last year. By 2020, the shale boom is expected to lower the U.S. trade deficit by $164 billion (almost a third) as energy imports continue to decline. The lower energy costs will benefit manufacturing and industry, particularly energy-intensive industries such as petroleum refining, aluminum, glass, cement and the food industry.[i]

The report cautions that the extra money to the government and to consumers is not guaranteed because potential restrictions on land use or extraction methods could have serious impacts on the results. According to the IHS report, proposed regulations on hydraulic fracturing could “push the industry’s economic benefits below even today’s levels.”[ii]

EIA’s Analysis

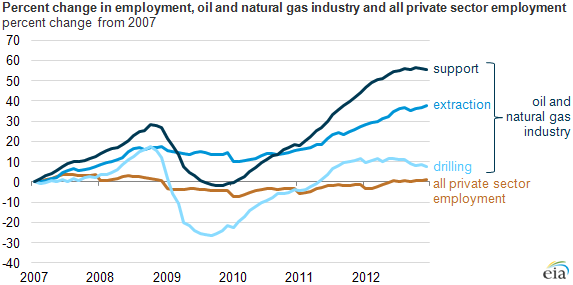

According to the EIA, total U.S. private sector employment increased by more than one million jobs between the beginning of 2007 and the end of 2012, while the oil and natural gas industry increased employment by more than 162,000 jobs. The oil and gas jobs were in the areas of drilling, extraction, and support, which are the 3 categories in which the Bureau of Labor Statistics accounts for oil and natural gas industry employment. Employment in the drilling category accounted for more than 90,000 jobs by the end of 2012, an increase of 6,600 jobs since 2007, and extraction employment totaled more than 193,000 jobs by the end of 2012, 53,000 more jobs than in 2007. The support category, which includes exploration, excavation, well surveying, casing work, and well construction, employed more than 286,000 people by the end of 2012, an increase of more than 102,000 jobs since 2007. The three industry categories combined equal one-half of one percent of total U.S. private sector employment.[iii]

Source: Energy Information Administration, http://www.eia.gov/todayinenergy/detail.cfm?id=12451

Based on data from the Bureau of Labor Statistics, six of the seven metropolitan areas with population of 50,000 or more having the lowest jobless rates are located in areas of shale energy development. These areas include Bismarck, N.D. with a 2.5 percent unemployment rate; Sioux Falls, S.D. with a 3 percent unemployment rate; Fargo, N.D. with a 3.3 percent unemployment rate; Midland, Texas with a 3.5 percent unemployment rate;, and Rapid City, S.D. also with a 3.5 percent unemployment rate.[iv]

The oil and gas industry activity also directly supports output and employment in other domestic sectors, such as suppliers of pipes and drilling equipment. In addition, indirect employment effects occur from industry and employees purchasing goods and services. As EIA notes, higher paying oil and gas industry jobs tend to have larger indirect effects on output and employment than lower paying jobs.

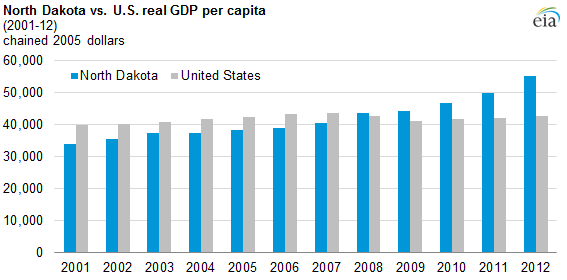

Using data from the Bureau of Economic Analysis, EIA also found that oil production in the Bakken shale formation resulted in significant increases in the real gross domestic product (GDP) per capita of North Dakota. In 2001, North Dakota’s GDP per capita was well below the U.S. average, ranking 38th out of 50 states. Starting in 2004, the state’s GDP per capita rose each year, surpassing the U.S. average in 2008. By 2012, North Dakota’s real GDP per capita was more than 29 percent above the national average. For the second consecutive year, North Dakota reported the highest annual increase in real per capita GDP of any U.S. state in 2012, increasing by almost 11 percent from the previous year, which is much higher than the national growth rate of less than 2 percent and more than three times higher than the growth rate of Texas (3.27 percent, and another surging energy output power) — the state with the next highest annual growth.[v]

Source: Energy Information Administration, http://www.eia.gov/todayinenergy/detail.cfm?id=12071

The IHS Study

As indicated above, the study found that the oil and gas production boom created 2.1 million direct and indirect jobs by the end of last year, which is expected to increase to almost 3.9 million jobs by 2025. Further, these new sources of domestic oil and natural gas added more than $1,200 to the discretionary income of the average U.S. family in 2012, which is expected to increase to $3,500 by 2025.

The largest impact on U.S. households is due to lower electricity and heating bills, which account for about 75 percent of the average household’s gains. About $800 of that is due to lower prices for natural gas-fueled heat and cooking, and $100 to $150 is from electricity rates that are lower than they otherwise would be. Since 2008, residential natural gas prices fell between 12 percent and 32 percent. The IHS study assumed that U.S. natural gas prices would stay near 2008 levels.[vi]

The boom has sparked more than $120 billion in U.S.-based investment last year. Foreign and U.S. chemical companies invested $4.8 billion in American plants last year and are expected to spend an estimated $12.8 billion in 2015. By 2025, total new chemical investments are expected to increase to $129.3 billion, creating 319,000 new jobs. The competitive advantage for U.S. manufacturers from lower fuel prices is expected to raise industrial production by 3.5 percent by the end of the decade. According to the IHS study, as more wells are drilled and produced, 47,000 miles of new and expanded pipelines will need to be added by 2025 to move the oil and gas.

The largest gains were found to be in Texas, with 576,000 jobs added by the end of last year. Due to low natural gas prices, more manufacturing is expected to come to Texas. Industrial natural gas prices in Texas are half the level paid by manufacturers in New Jersey, one-third of the cost faced by European manufacturers and a fourth of what Asian factories pay. Due to the low natural gas prices, four international steel firms announced they will spend $3.3 billion in new plants in Texas — two outside Corpus Christi, one in Bay City and one in Bryan.[vii]

Other Studies

According to a study by PwC, in 2011, the oil and gas industry supported 9.8 million jobs, an increase of over 600,000 from 2009 levels. The oil and gas industry supports 8 percent of the U.S. economy, higher than the 7.7 percent it supported in 2009. According to the study, the oil and gas industry supports jobs in all 50 states, but Texas is America’s oil and natural gas leader, with the industry supporting nearly two million jobs in the state and making up 23 percent of the state’s economy. Texas was followed by California with almost 800,000 jobs and about 7 percent of the state’s economy, followed by Louisiana with 400,000 jobs and 35 percent of the state’s economy.[viii]

And, according to Moody’s Analytics, an economics consulting firm, 1 million of the 2.7 million jobs gained in the United States between 2002 and 2012 were related to shale oil and gas drilling.

In contrast, according to a recent analysis by the American Council for an Energy Efficient Economy, the energy-efficiency legislation authored by Senators Jeanne Shaheen and Rob Portman, coupled with related amendments, would support only 81,000 jobs by 2020, 152,000 by 2025, and 174,000 jobs by 2030.[ix] The 2025 number is less than 4 percent of the jobs that the shale oil and gas boom is expected to generate by 2025.

Conclusion

The shale oil and gas revolution is not only having large impacts on oil and natural gas production in the United States, but it is also having large impacts on unemployment, economic growth, and the manufacturing industry comeback in this country. According to Daniel Yergin, IHS Vice Chairman, “The unconventional oil and gas revolution is not only an energy story, it is also a very big economic story.” The impact is “only now becoming apparent.”[x] “The growth of long-term, low-cost energy supplies is benefiting households and helping to revitalize U.S. manufacturing, creating a competitive advantage for U.S. industry and for the United States itself.”[xi]

The economic activity in the oil and gas sector is happening despite federal government action, instead of because of government involvement, as we have already shown. Comparing the job increases in the oil and gas sector to that of government sponsored energy efficiency programs can provide a comparison for policymakers who have sought government energy management programs as a means to create jobs. The comparison shows clearly that the private sector’s response to markets, investment and technology provides far more benefits than government dictates and subsidies. The job increases in the oil and gas sectors of our economy without government intervention dwarf those claimed in the study of those supporting heavy-handed Washington, D.C. edicts to the private sector.

[i] Fox Business, Energy Boom to Help Boost American Jobs, Salaries, September 4, 2013, http://www.foxbusiness.com/industries/2013/09/04/report-energy-boom-windfall-for-family-income/

[ii] Nationl Review, Energy Industry: Let Us Frack or the Economy Will Suffer, September 4, 2013, http://www.nationaljournal.com/energy/energy-industry-let-us-frack-or-the-economy-will-suffer-20130904

[iii] Energy Information Administration, Oil and gas industry employment growing much faster than total private sector employment, August 8, 2013, http://www.eia.gov/todayinenergy/detail.cfm?id=12451

[iv] Energy Tomorrow, August 2013, http://energytomorrow.org/blog/2013/august/for-us-oil-natural-gas-every-day-is-labor-day

[v] Energy Information Administration, North Dakota sees increases in real GDP per capita following Bakken production, July 12, 2013, http://www.eia.gov/todayinenergy/detail.cfm?id=12071

[vi] USA Today, U.S. energy lifting the economy more than expected, September 4, 2013, http://www.usatoday.com/story/money/business/2013/09/04/us-energy-economy-impact/2742461/

[vii] Dallas News, Study: Widespread economic gains seen from oil and gas boom, September 4, 2013, http://www.dallasnews.com/business/energy/20130904-study-widespread-economic-gains-seen-from-oil-and-gas-boom.ece

[viii] PWC, Economic Impacts of the oil and natural Gas Industry on the US Economy in 2011, July 2013, http://www.api.org/news-and-media/news/newsitems/2013/aug-2013/study-600000-new-jobs-supported-by-oil-and-natural-gas-industry-in-two-years

[ix] American Council for an Energy-Efficient Economy, Economic Impacts of the Energy Efficiency Provisions in the Energy savings & Industrial Competitiveness Act of 2013 and Selected Amendments, September 2013, http://aceee.org/files/pdf/white-paper/shaheen-portman-2013.pdf

[x] ABC News, Jobs Boom From US Oil and Gas, September 4, 2013, http://abcnews.go.com/blogs/business/2013/09/jobs-boom-from-us-oil-and-gas/

[xi] Bloomberg Business Week, Fracking Boom Seen Raising Household Incomes by $1,200, September 4, 2013, http://www.businessweek.com/news/2013-09-04/fracking-boom-seen-raising-u-dot-s-dot-incomes-by-1-200-per-household