For the third time in the past 5 months The Washington Post has called for new taxes on energy. This time the Post is calling for a carbon tax because cap-and-trade regimes for greenhouse gas emissions are flawed. According to the Post:

Cap-and-trade regimes have advantages, notably the ability to set a limit on emissions and to integrate with other countries. But they are complex and vulnerable to lobbying and special pleading, and they do not guarantee success.

The experience of the European Union is Exhibit A.

The Post’s answer to the flaws with cap-and-trade schemes is to implement a carbon tax instead. Cap and trade and carbon taxes have a similar goal—increase the price of energy to encourage conservation. Carbon taxes increase the price of anything that uses oil, coal, or natural gas an input. This includes nearly all goods or services in the United States because 85 percent of the energy we use comes from coal, oil, or natural gas.

Increasing the costs of doing business in American makes it harder for American businesses to compete with foreign companies. The high price of natural gas in the United States has already contributed to the loss of 3.1 million manufacturing jobs since 2000.[1] Higher energy taxes will further drive more businesses overseas and make life more difficult for American consumers struggling to make ends meet.

It is not clear what The Washington Post hopes to accomplish with a carbon tax. The earth has warmed over the past 30 years, but not as much as the climate models predict. Climate alarmists point to the models as evidence of catastrophic warming, even though there has been no warming trend since 2001 according to the satellite data.

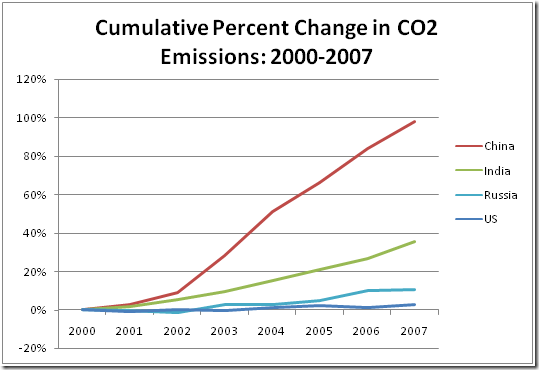

One thing that is clear is that a unilateral carbon tax imposed on U.S. citizens will do little to nothing about global warming. Global carbon dioxide emissions are not driven by the United States, but by the developing world. According to data from the Global Carbon Project, between 2000 and 2007 the U.S.’s carbon dioxide emissions increased 3% while China’s increased 98% and became the world’s largest emitter of carbon dioxide. By way of comparison, from 2000 to 2007 India’s carbon dioxide emissions increased 36%, the global total increased 26%, Russia’s increased 10%, and Japan’s increased 3%. These data are displayed in the graph below:

The U.S. will emit a smaller and smaller share of the world’s total greenhouse gas emissions[2] making unilateral efforts, such as a domestic carbon tax, ineffective at influencing climate. If the U.S. were to completely cease using fossil fuels, the increase from the rest of the world would replace U.S. emissions in less than eight years.[3]

The Washington Post says that “A carbon tax, by contrast, is simple and sure in its effects.” This is correct. A carbon tax is simple, and we can indeed be sure of its effects: it will harm America economically with few corresponding environmental benefits.

[1] Paul N. Cicio, Testimony of Paul N. Cicio, President of Industrial Energy Consumers of America before the House of Representatives, Dec. 6, 2007, http://www.ieca-us.com/documents/IECAHouseTestimony-NaturalGas_12.06.07.pdf.

[2] According to the Global Carbon project in 2007 China emitted 21% of the world’s carbon equivalent and the U.S. emitted 19%.

[3] Calculated using the emission data from the Global Carbon Project. According to these data, the U.S. emitted 1,586,213 GgC in 2007. Without the U.S., the world’s emissions were 5,203,987 GgC in 2000, increasing to 6,884,787 GgC in 2007.